Europe’s climate and green industrial policies have faced criticism over lack of funding and coordination, but a shortage of skilled workers could be the key stumbling block for meeting the EU’s green ambitions. This policy brief shines a light on the challenges posed by this shortage. First, it provides an overview of the EU’s aspirational clean tech objectives. Second, it seeks to present a more nuanced perspective on the specific skill and labor requirements for producing and deploying key clean technologies, by providing an initial estimate for the workforce needed to meet the Union’s climate and industrial targets by 2030. Finally, it delves into the factors contributing to potential labor market bottlenecks and underscores the urgent need for targeted and coordinated policy actions.

For a full version of this Policy Brief including the Annex and footnotes, please download the PDF above.

1. Introduction

Over the years, the EU has put in place aspirational targets to scale up the deployment and manufacture of clean technologies across member states. While there are several barriers that could thwart the achievement of these targets, the availability of skilled workers could turn out to be the key limiting factor for the EU’s green ambitions. Investments alone will not manufacture batteries for electric vehicles, install solar panels on rooftops, or operate offshore wind farms. As Commission President von der Leyen has put it: “The best technology is only as good as the skilled workers who can install and operate it”. Still, concerns linger that EU member states might fail to equip enough workers with the green skills needed to get the job done at pace.

This brief systematically analyses the extent to which these concerns are justified. To do so, it seeks to cut through the buzzwords surrounding the EU’s climate and green industrial policies, injecting concrete numbers into the often vague discussions about surging skill and labor needs essential for the success of these policies. Crucially, the brief highlights the twin challenge that the EU faces in ramping up the deployment and manufacture of clean technologies. It goes on to provide an initial estimate of the skilled workforce required to roll out key clean technologies within Europe. While further analyses based on in-depth skills and labor market intelligence remain imperative, the data underscores the urgent need to expand the current clean tech workforce substantially and swiftly, particularly when it comes to deployment. Finally, the brief contours the factors fueling labor and skills shortages that will impede the realization of these targets, if policy actions fail to match the rhetoric.

The policy brief argues that if the EU is to reach its green ambitions, four fundamental policy changes are needed. First, tapping into diverse talent pools via the active inclusion of people outside of the current workforce, such as women and migrant workers, is vital. Second, green jobs must become more attractive vis-à-vis ‘brown’ jobs to entice skilled workers. Therefore, the EU should consider introducing job quality requirements when designing green industrial policies. Third, the EU needs to smooth the transition of workers into clean tech sectors through streamlined training programs and enhanced cross-border recognition of qualifications. Targeted support is critical for low- to medium-skilled workers that matter for the envisioned scale-up of clean tech projects. Finally, the EU should be more selective. Confronted with a sustained scarcity of skilled labor and a shrinking working age population, the EU should prioritize the deployment of clean technologies, and the creation of high-quality manufacturing jobs in those sectors that contribute value to transforming the EU’s industrial base.

2. The EU’s heady ambitions for clean tech deployment and manufacturing

The European Green Deal serves as the overarching strategy aimed at guiding the EU through a green transition, with the ultimate aim of transforming Europe into “the first climate-neutral continent” by 2050. Attaining this goal will hinge on the large-scale deployment of clean technologies such as solar PV and on- and offshore wind. Consequently, the EU has established ambitious targets for switching to renewables in the form of the Fit-for-55 package and the REPowerEU plan, requiring a substantial workforce to build up wind and solar farms.

What matters here is that the European Green Deal is increasingly being recognized not merely as a climate pledge but also as a commitment to securing a competitive manufacturing base that creates sustained jobs on the continent. Given that manufacturing significantly contributes to economic growth and job creation – constituting 14.7% of GDP and 14.1% of the bloc’s total workforce in 2021 – a successful industry transformation is deemed paramount. However, concerns are growing that the EU might miss out on the green technologies of the future due to open-handed green industrial policies in China and the US. In response, the European Commission announced the Green Deal Industrial Plan (GDIP) in February 2023, with the Net Zero Industry Act (NZIA) as its regulatory centerpiece. Geared towards bolstering competitiveness and reducing strategic dependencies, the NZIA sets explicit targets for onshoring production capacities in key clean technologies. These additional manufacturing targets add to the rising labor demand for skilled workers in clean tech sectors.

The EU thus faces a twin challenge. It wants to ramp up simultaneously the installation and production of clean technologies in Europe, all while it is confronted with a scarcity of skilled workers. In the following, both challenges are examined in more detail.

The clean tech deployment challenge: crucial for the climate

The EU has put in place ambitious targets for the deployment of clean energy technologies. In response to the Russian invasion of Ukraine and related disruptions in the energy market, the Union reinforced its ambition to boost the share of renewables in its energy mix by 2030. This is reflected in the REPowerEU plan, which raised the renewable energy target of the Fit-for-55 package from 40% to 45%, in order to slash dependency on Russian gas and oil.

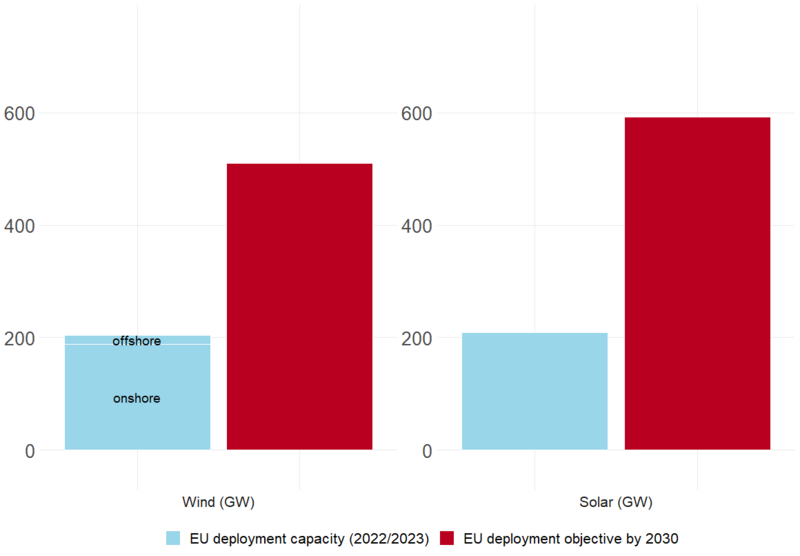

In practice, meeting this renewable energy target will require a rapid on-the-ground expansion of wind and solar energy capacities throughout EU countries (see figure 1). Accordingly, the Commission estimates that a cumulative capacity of 592 GW for solar PV and 510 GW for wind must be installed by 2030. By 2022, the installed solar capacity in the EU had reached around 209 GW and cumulative wind power capacity in the EU 204 GW, with 188 GW attributed to onshore wind power installations. Annual additions will have to increase significantly to keep up with these ambitious targets. As such, the International Energy Agency (IEA) forecasted necessary average annual additions of 48 GW for solar PV and 36 GW for wind from 2022 through 2030.

However, there is increasing skepticism that EU countries will be able to meet their deployment objectives by 2030. Whereas recent annual additions of solar capacity have outshone expectations, the tailwind boosting the deployment of wind capacity has become noticeably weaker. Critically, annual additions in both sectors fell short of the pace necessary to meet the REPowerEU target, with the addition of 41 GW of new solar capacity and only 16 GW of new wind power capacity across EU countries in 2022. These deployment figures reflect barriers rooted in an uncertain investment environment and cumbersome permitting procedures. Yet, even if these hurdles could be overcome, deployment at the envisioned scale and pace will crucially depend on Europe’s ability to get enough hands to install solar panels and wind turbines.

Figure 1: Installed clean tech capacities in the EU & ramp-up needed to meet REPowerEU targets by 2030.

The EU’s clean tech manufacturing challenge: strengthening the EU’s industrial base and resilience

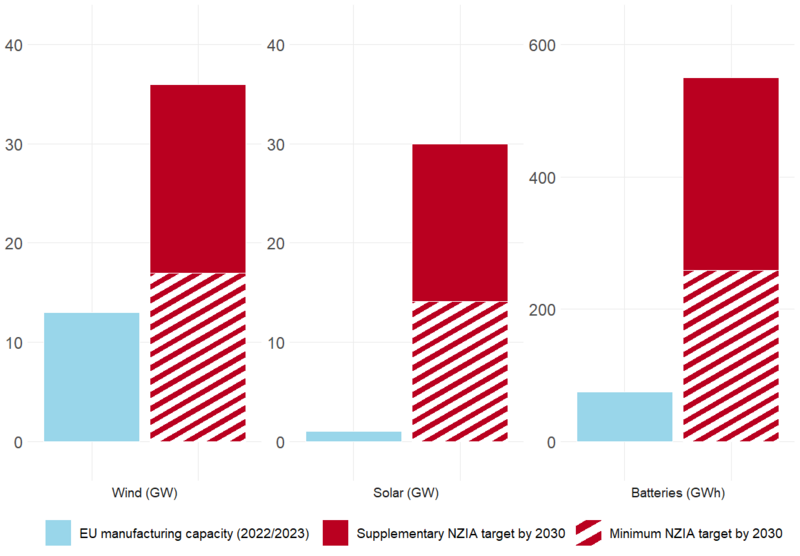

The second challenge relates to clean tech manufacturing. Whereas the widespread deployment of solar and wind is vital for meeting the EU’s climate obligations, aspirations to expand domestic clean tech manufacturing are driven by fears of deindustrialization and concerns about security of supply. The NZIA is at the center of the Commission’s “plan to make Europe the home of clean tech and industrial innovation”. Therefore, the proposal aims to enhance investment conditions in the EU so as to bolster home-grown manufacturing for eight designated “strategic net-zero technologies” including, among others, solar PV, batteries, and wind. Critically, the NZIA sets a headline target of manufacturing at least 40% of the bloc’s annual deployment needs in all these sectors by 2030. This minimum objective is supplemented by even more ambitious sector-specific targets outlined in the recitals of the proposal.

Meeting these objectives will require a substantial ramp-up of manufacturing capabilities for clean tech products across EU member states (see figure 2). Accordingly, current EU-wide production and processing of solar PV components such as ingots, wafers, cells, and modules remains limited. For example, only about 10% of the 41 GW of solar PV modules deployed in 2022 was produced in the EU. Even the most advanced segments of the solar PV value chain in Europe, polysilicon and inverter manufacturing, would require substantial expansion to reach the NZIA’s minimum target.

Unlike the solar sector, European wind manufacturers were able to develop and maintain a strong footprint in the global wind industry. Currently, five of the top 15 wind turbine manufacturers globally are based in Europe. Therefore, the EU was able to cover about 85% of its deployment needs domestically in 2022. While this aligns with the supplementary manufacturing target set by the NZIA, there may well be an uphill struggle to expand current production capacity enough to maintain a market share matching this target by 2030.

EV batteries represent a key technology for the ongoing shift towards electromobility in transport. In 2022, the sales of EVs already comprised 21% of all new car sales, a substantial increase from around 3% three years earlier. However, European EV production remained largely dependent on Asian suppliers of batteries or battery components. Only half of Europe’s demand for batteries was met locally in 2022. Yet, recently announced investments in EU-based EV battery manufacturing have raised hopes that this is about to change. Consequently, there are estimates that total production capacity in Europe could reach up to 1,227 GWh by 2030, surpassing the NZIA’s supplementary target of producing 90% of the annual deployment needs.

Crucially, while the NZIA sets very ambitious targets for EU-based clean tech manufacturing, it fails to provide a clear roadmap for achieving these targets, in particular when it comes to the question of skilled labor. The proposal itself aims mainly at streamlining and fast-tracking the EU’s lengthy permitting procedures which have historically impeded investments in clean tech manufacturing sites in Europe. However, the success of new manufacturing projects hinges on having a skilled workforce to bring them to fruition.

Figure 2: Current clean tech manufacturing capacities in the EU & ramp-up needed to meet NZIA targets by 2030

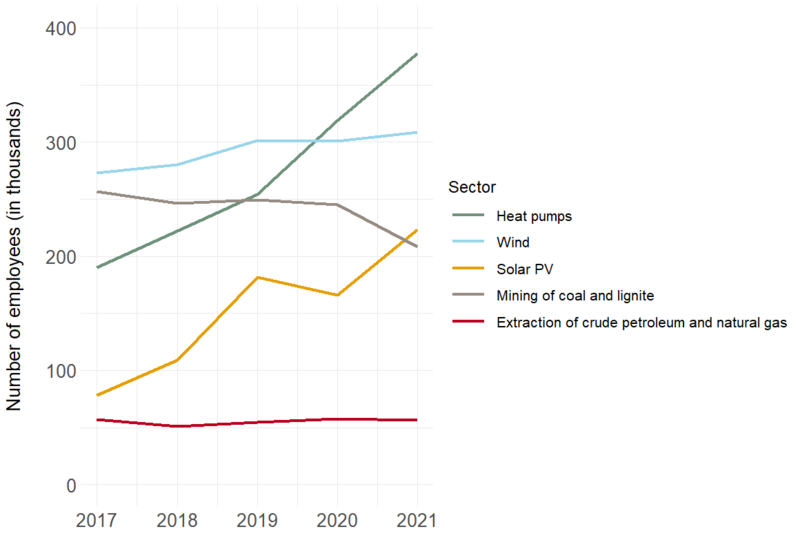

3. A swift reality check on the labor market: estimating the skilled workforce needed

To meet these goals, European labor markets will need to undergo profound structural changes. On the one hand, the planned phase-out of fossil fuels will eliminate a substantial number of existing jobs. One third of EU-wide employment in manufacturing is tied to energy-intensive goods, with increasing pressure to transform established production procedures. As a result, many workers will be required to undertake reskilling or upskilling programs to adapt to the evolving employment landscape. On the other hand, the targeted expansion of clean tech manufacturing and deployment will demand a rapidly growing workforce. This is illustrated by the significant employment growth observed in low-carbon sectors in recent years (see figure 3). In 2019, the EU renewables sector accounted for 1,248,300 direct and indirect jobs. By 2021, this figure had increased to around 1,470,000. This translated to around 0.76% of total employment in the EU. The heat pumps sector led the way with 377,300 jobs. Meanwhile, the wind energy industry employed around 300,000 workers in 2022 and the solar power sector comprised about 223,100 directly and indirectly employed workers in 2021. The industry group SolarPower Europe even estimated as many as 205,000 direct jobs and 261,000 indirect jobs created by the solar sector in 2021.

Figure 3: Employment trends in EU27 clean tech and fossil fuel industries, 2017-2021

Against this background, the subsequent analysis takes a first glance at the anticipated labor and skills needs resulting from the EU’s ambitious objectives on deployment and domestic manufacturing of solar panels, wind turbines, and EV batteries. The focus on these three clean technologies is due to availability of data, allowing for finer-grained estimates illustrating the future labor demand along different value chain segments by 2030. NB, these estimations rely on data made publicly available by the industry and come with inherent uncertainties. (Economies of scale due to technological advances and increased production efficiency may reduce labor needs per unit produced over time.)

The analysis is structured into two sections, with a focus on labor and skill needs in (1) deployment and (2) manufacturing of solar, wind, and batteries. Each section will begin by examining the types of jobs required before providing preliminary projections of the overall labor demand in each sector.

a. Deployment

What kind of jobs will be needed for solar and wind deployment

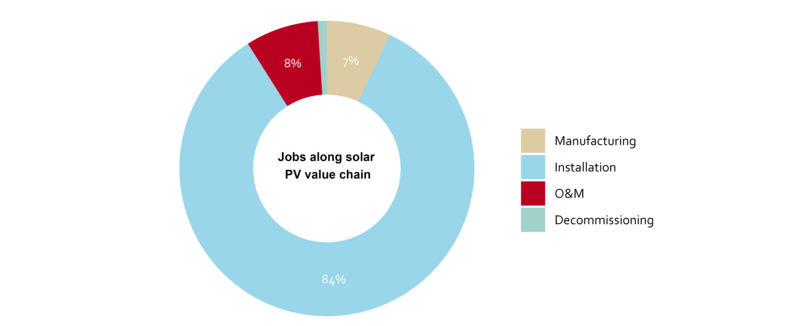

Accelerated PV deployment is the main driver of employment growth in the European solar industry. The installation of solar panels on land and rooftops is very labor-intensive, with distributed residential solar systems necessitating relatively more workers than utility-scale solar projects. Most of the installation tasks in the residential sector are exercised by low- to medium-skilled workers with technical knowledge, such as roofers. However, the connection to the grid typically requires trained electricians. Naturally, the total number of deployment jobs correlates strongly with the annual addition of new solar PV capacity. Hence, the rapid expansion of installed solar panels during the last three years has led to a steep increase in deployment jobs. By 2022, more than four out of five existing solar jobs in the EU were related to the installation of solar panels (see figure 4). Accordingly, most jobs are concentrated in countries with large established PV markets, such as Germany, Poland, Spain, France, and the Netherlands so far.

Figure 4: Distribution of jobs along the European solar value chain in 2022

While many workers are needed to put solar panels on people’s rooftops, once deployed, their operation and maintenance are much less labor-intensive. Nevertheless, operation and maintenance (O&M) jobs are relatively stable and less vulnerable to market fluctuations than jobs in solar deployment, as they primarily depend on the cumulative installed capacity. Large-scale solar utilities are often monitored remotely, with maintenance activities constituting the larger share of jobs at this stage of the value chain. Notably, many of the tasks in O&M do not require highly skilled engineers, but rather a specialized workforce with technical skills. Meanwhile, the number of jobs related to the decommissioning of solar panels remains relatively low, as lift-off here is not expected until the next decade.

In contrast to solar, the wind sector exhibits lower labor requirements per deployed unit of capacity. However, installation of wind turbines requires more material resources and specialized equipment to transport the components. Notably, about three-quarters of the tasks related to the construction and installation of onshore wind turbines requires trained workers with low to medium skill levels. With offshore wind, this includes terminal and marine crews operating at ports and on vessels. While high-skilled individuals with a higher education degree usually exercise the initial site selection, plant design as well as technical and financial feasibility assessments, these roles are significantly fewer in number.

Compared to jobs related to wind power installations, the workforce necessary to operate and maintain new build wind farms is expected to grow at a more gradual but steadier pace over time. Notably, ongoing efficiency gains brought by newer and larger generations of wind turbines are likely to decrease the O&M workforce required per unit of installed capacity. On the other hand, decommissioning and repowering activities should become more important, as many onshore wind farms will reach the end of their operational lifetime towards the close of this decade. Commonly, about two-thirds of the decommissioning work related to onshore wind can be exercised by construction and technical workers.

How many jobs will be needed for solar and wind deployment

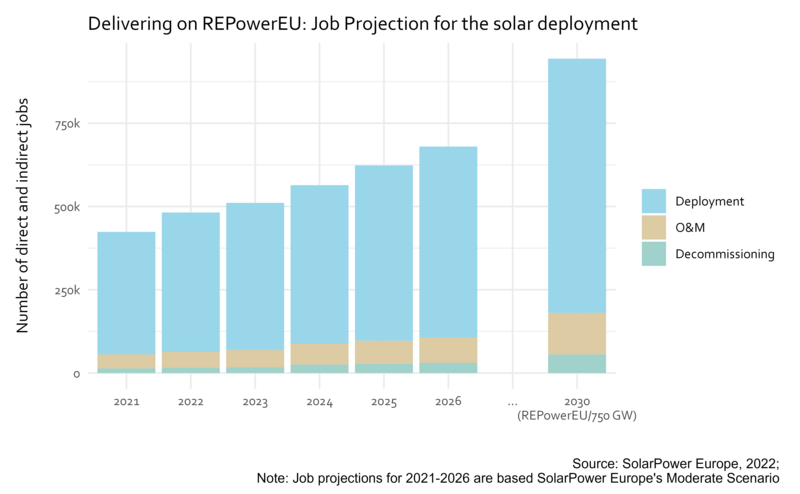

Meeting REPowerEU’s target of installing 592 GW of solar capacity across the bloc by 2030 would be associated with sharply increasing demand for skilled workers in the deployment segment. Accordingly, the industry association SolarPower Europe estimated that the number of people employed in the deployment of solar would need to more than double by the end of the decade. This would translate to an increase from almost 367,000 direct and indirect jobs in solar deployment in 2021 to more than a total of 763,000 jobs by 2030. Assuming that the current ratio between direct and indirect employment will remain relatively stable over time, about 336,000 of these would be direct jobs. While these industry projections should be taken with caution, they alone would exceed direct employment in fossil-fuel-related extractive and processing activities, which was around 316,000 in 2021. Crucially, solar deployment would represent about three-quarters of the projected total labor demand in the sector, whereas O&M jobs are estimated to account for 12% and decommissioning jobs for 5% of the required personnel in the same year.

Figure 5: Delivering on REPowerEU: Projected labor needs for the deployment of solar PV by 2030

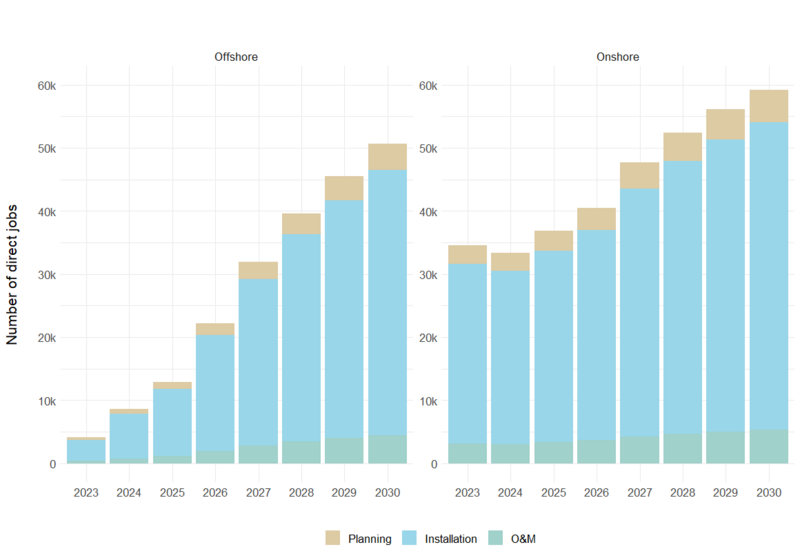

While labor demand for wind deployment is anticipated to be smaller than that for solar, our projections indicate a significant increase if wind capacity is expanded in line with the REPowerEU target. Consequently, realizing a cumulative capacity of 440 GW of wind energy through the installation of an additional 154 GW onshore wind capacity and about 95 GW of added offshore wind capacity by the end of the decade is projected to require more than 90,000 workers dedicated to the installation of wind turbines in 2030 (see figure 6). Out of these direct jobs, 42,000 would be specifically linked to the deployment of offshore wind capacities, which are anticipated to grow steeply. While employment needs in planning and O&M tasks are expected to increase as well, the additional employment required at these stages of the value chain is projected to remain marginal in 2030 in contrast.

Figure 6: Delivering on REPowerEU: Projected additional labor needs for the deployment of wind by 2030

b. Manufacturing

What kind of jobs will be needed for solar, wind and battery manufacturing

The projected overall labor demand in clean tech manufacturing is markedly lower than for deployment. However, meeting the EU’s clean tech production goals would still require a significant expansion of the workforce in key sectors.

Jobs in manufacturing represent only a limited share of the overall workforce in the European solar industry. This is unsurprising given the small overall size of the EU’s current production capacities. In 2022, solar manufacturing accounted for around 48,000 direct and indirect jobs. Among the various stages of the solar PV manufacturing process, the production of cells and modules is the most labor-intensive, whereas manufacturing inverters, ingots and wafers require significantly fewer workers. The production of polysilicon generates the least jobs per unit produced. Producing more than 70 GW of capacity, manufacturers of inverters accounted for around 73% of the total manufacturing workforce in the European solar sector in 2022. In general, almost two-thirds of the workforce required to manufacture solar panels and their components are factory workers and technicians with low to medium skills, whereas engineers make up around 10%.

Unlike the solar PV sector, the wind industry has already established a sizeable manufacturing base in the EU. In fact, more than half of the direct employment within the wind industry was associated with manufacturing wind turbines, turbine components, and offshore foundations in 2019. Typically, the production of the nacelle, including its subcomponents, is the most labor-intensive process. Additionally, the construction of foundations and substations for offshore wind turbines represents a significant share of the labor needs associated with wind manufacturing. Since the transport of these pieces by land remains relatively cumbersome, the production of those bulky offshore wind components is usually located in coastal areas. More than half of the workforce at this stage of the value chain consists of factory workers with low to medium skill levels.

Whereas EU-wide employment in battery manufacturing is limited so far, the sector is set to play a critical role in the transformation of the established domestic automotive value chain. Eurostat estimates that almost 3.1 million people were employed in roles directly or indirectly linked to automobile manufacturing in the EU in 2021. Recent studies underline that the onshoring of battery manufacturing could help to counterbalance job losses resulting from the transition towards electromobility. For example, a study by the Fraunhofer Institute points out that the creation of battery cell manufacturing capacities could offset jobs that will disappear due to the declining production of conventional cars. Moreover, research in the US context indicated that the EV production process might even generate more work than the conventional powertrain, provided that all components are manufactured domestically.

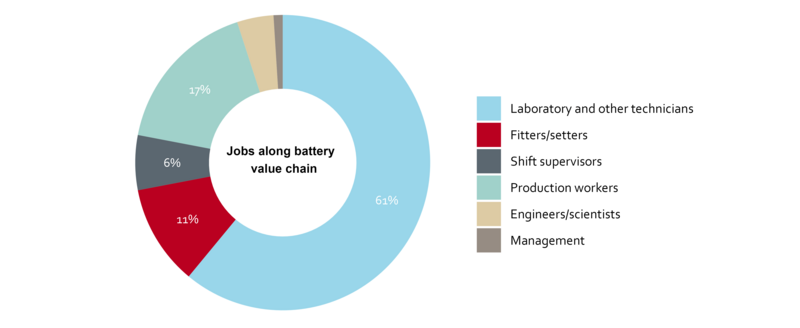

When focusing on battery production, the manufacture of battery cells accounts for the highest employment needs per unit of capacity. In comparison, battery pack production and machinery and equipment supply are considerably less labor-intensive. The majority of tasks in battery cell manufacturing can be exercised by workers without extensive prior experience or an academic background in the battery sector. However, there is a high demand for workers with specialized technical skills. As such, a study on the battery cell production in Germany finds that around 78% of the labor needs is for workers with relevant vocational training (see figure 7).

Figure 7: Distribution of job roles in battery manufacturing in Germany

How many jobs will be needed in solar, wind, and battery manufacturing

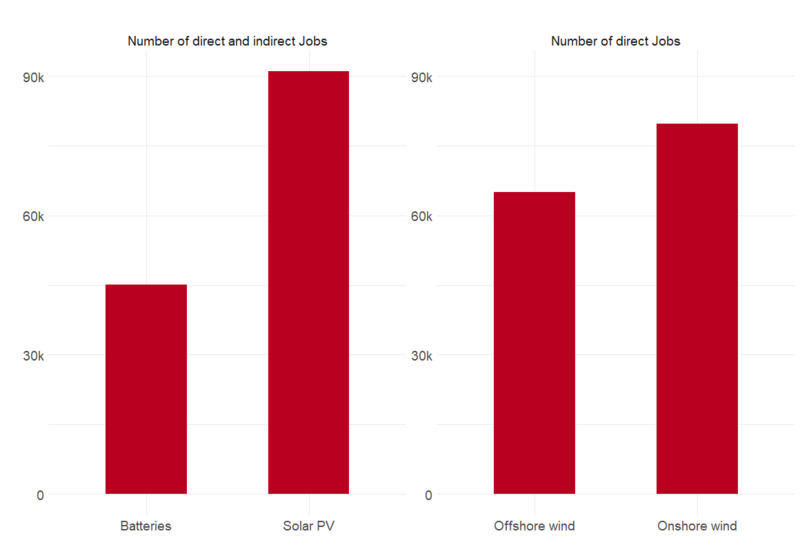

In comparison to the surging need for skilled workers in the deployment of solar PV capacity, the projected labor demand for solar manufacturing by 2030 appears modest. As such, SolarPower Europe forecasts a need for around 77,000 manufacturing workers in 2026, with this rising to approximately 91,000 by 2030 (see figure 8). NB, this projection assumes an increase in domestic manufacturing capacities across all solar PV components. The dynamics differ in the wind industry, where the demand for skilled labor in manufacturing could exceed that for installation. Our estimates suggest that meeting the NZIA’s supplementary target of domestically producing 85% of the annual wind installations would entail a significant expansion of the wind manufacturing workforce. In the case of offshore wind, European manufacturing facilities would need an additional 39,000 workers in 2030. Besides, more than 26,000 jobs would be necessary for manufacturing offshore foundations in the same year. In addition, it is estimated that nearly 79,000 new job positions would need to be filled in onshore manufacturing to meet the NZIA target.

While comparatively moderate in number, meeting the estimated labor needs in battery manufacturing is expected to be essential for a smooth transition of the European automotive sector. We estimate that to build up domestic battery production capacities able to cover an annual demand of 550 GWh by 2030, the sector would need to attract more than 45,000 new workers in total by the end of the decade. The largest share of these direct and indirect jobs would be associated with manufacturing battery cells, which is expected to account for about 21,500 of the jobs required.

Figure 8: Projected additional labor needs for clean tech manufacturing in 2030

The above analyses contoured sharply increasing labor needs associated with the envisioned expansion of clean tech deployment and manufacturing across EU countries. Notably, the estimates indicate that these labor needs are expected to be particularly pronounced for the deployment of wind and solar. Crucially, the workforce required is not exclusively composed of professionals with academic degrees. Quite the opposite, most of the projected labor demand is for vocationally trained workers in low to medium skill roles.

4. Policy recommendations to address daunting skills and labor shortages

Our analysis shows that job positions related to net-zero technologies will need to surge to meet the EU’s climate and clean-tech manufacturing targets. The challenge will be to fill them. Several sectors and occupations that will be crucial for the manufacture and deployment of clean tech are already grappling with sustained labor and skills shortages. As we show above the planned ramp-up of net-zero technology manufacturing will depend on the availability of skilled workers in technical occupations. This involves construction workers, truck drivers, electricians, electrical mechanics, and civil engineers. Worryingly, all of these are identified as ‘shortage occupations’ by the European Labor Authority. This lack of skilled workers has already hampered investments in net-zero technologies. Accordingly, about 85% of the firms participating in the European Investment Bank’s annual investment report stated that skills shortages, particularly concerning engineering and digital skills, were impeding investments from moving forward. Our analysis suggests that meeting the EU’s green ambitions will be impossible without addressing these labor market bottlenecks. As such, the anticipated workforce demand for the deployment of wind and solar alone is estimated to reach up to 854,000 workers in 2030, while the manufacture of wind turbines, solar panels and EV batteries is projected to require about 280,000 workers in the same year.

If EU member states want to live up to the intensifying skills and labor challenge posed by the projected steeply increasing demand in clean tech sectors, four well-coordinated and targeted policy actions are imperative:

1) Policy recommendation: The EU needs to unlock untapped labor market potentials

The previous analysis has underscored the surging labor demand for vocationally trained workers in key clean tech sectors. While it is crucial to enhance the attractiveness and reputation of vocational education programs - often still seen as a second choice by young people - solely relying on the younger generation will not suffice to bridge the growing skilled labor gap. Instead, the EU must also mobilize untapped employment sources whose absence is contributing to the daunting labor and skill shortages in clean tech sectors.

For instance, women’s share in clean tech sectors and pivotal occupations remains limited. Within the EU, women account only for 18% of the workers in the wind industry and 27% of the solar PV workforce, contrasting with an EU industry average of around 46.6%. In terms of specific occupations, women make up only 18% of plant and machinery operators and assemblers in the EU. Failing to enable greater overall labor market participation of women, by overcoming financial and cultural barriers, would mean missing out on a vast reservoir of talent integral to clean tech sectors’ growth.

As such, the green transition requires a multifaceted approach that includes investing in the adult population as well as building up the younger generation. Specifically, one must leverage diverse talent pools and target untapped sources via the active inclusion of people outside of the current workforce such as not only women but migrant workers and young people not in education, employment, or training (NEETs). Importantly, this should include the facilitation of labor migration from non-EU third countries, since even untapped labor market potential may fall short of the sharply climbing labor and skill needs in clean tech sectors. For instance, it is projected that Germany alone will require an annual net migration of around 400,000 workers to maintain a stable supply of its potential labor force until 2060, even under optimistic assumptions concerning the future labor market participation of women.

2) Policy recommendation: The EU needs to turn green jobs into attractive jobs

Meeting the twin challenge of ramping up clean tech deployment and manufacturing will depend on whether clean tech jobs are attractive enough to lure individuals working in fossil fuel industries in the short run. While it has often been assumed that jobs in clean tech are better paid, this seems not to be always the case yet. In the US, median annual salaries for jobs in conventional energy sectors such as oil and gas tend to be higher than those in renewables with comparable skill sets. Likewise, a study by the Grantham Research Institute at the London School of Economics indicates that low-carbon jobs in the UK and the US, despite paying above-average wages, typically do not offer a wage premium compared to similar non-green jobs. Part of the explanation might be that ‘brown jobs’ are often unionized, which provides workers with relatively strong job security and competitive compensation. In addition, labor demands in European clean tech sectors will likely alter once wind turbines and solar panels are deployed on a large scale, as these technologies require relatively less labor for operation and maintenance. To facilitate the transition of white- and blue-collar workers, it will be essential to establish clear career development paths.

The EU needs to take into account the fact that clean tech sectors compete for a shrinking workforce when it is designing its climate and green industrial policies. To make green jobs more attractive vis-à-vis brown jobs, the EU should contemplate introducing meaningful job quality requirements. This could be done, for example, in the context of procurement rules and the Important Projects of Common European Interest (IPCEIs) by tying public procurement and access to state aid to wage and apprenticeship standards. Recent industrial policies on the other side of the Atlantic may offer a potential blueprint to support the creation of high-quality clean tech jobs with conditionalities. If public money is used to support private investments, policymakers should ensure that public benefits are maximized.

3) Policy recommendation: The EU needs to smooth the transition into clean tech sectors

There is an urgent need to continuously adjust existing educational and training programs to match the skills requirements of emerging clean tech sectors. As such, existing educational and training programs have not kept pace with the changing jobs landscape brought about by the rise of clean technologies. According to CEDEFOP, as of 2020, 46% of European adults held low or outdated skills in advance of the twin green and digital transition. And while data from LinkedIn show that more workers are acquiring ‘green’ skills, the numbers also reveal that demand is outstripping this growth in supply.

In this context, the inevitable decline of fossil-fuel industries could offer a win-win opportunity for clean tech companies and former fossil-fuel workers. Studies suggest that many jobs in fossil-fuel industries are characterized by similar skill profiles as those needed in the clean tech economy and could therefore be transferable. Yet, such transitions are not necessarily smooth. Former fossil-fuel workers will still have to undergo some re- or upskilling and new job opportunities will not always be in the same regions where the polluting jobs are set to disappear. Crucially, the transition is more difficult for blue-collar workers, which are expected to be most severely affected by job losses in sectors covered by the EU Emission Trading System (ETS) via implementation of the Fit-for-55 targets. These workers face larger hurdles in transitioning, encompassing not only time and financial constraints, but also a lack of awareness of the need to re- and upskill for the green transition. As our analysis pointed out, the attainment of the EU’s green ambitions heavily relies on low- and medium-skilled workers, so it is vital to actively inform these workers about career prospects in clean tech sectors and enable them to take up re- and upskilling programs.

To facilitate the transitioning of skilled workers from ‘brown’ to ‘green’ sectors, EU member states should fully leverage Europe’s strengths by streamlining established vocational training programs, enhancing mutual recognition of qualifications, and facilitating intra-EU labor mobility. This coordinated approach would ease individual transitions and allow for a more efficient distribution of clean tech projects across the EU.

The proposed Net-Zero Industry Academies present a step in the right direction, aiming to develop standardized learning materials and programs on producing and installing clean technologies. These resources are intended to be utilized by national training providers. However, the impact of the Academies will hinge greatly on Member States’ willingness to promote and accredit these learning programs. Therefore, it is crucial to ensure that the Net-Zero Industry Academies are set up in collaboration with social partners and national stakeholders in order to prevent the creation of potential parallel structures and to design learning content that meets the specific needs of the industry.

4) Policy recommendation: The EU needs to be selective

Recruiting skilled workers from all available sources for high-quality clean tech jobs will be crucial, however, the EU must ensure that its climate and green industrial policies align strategically with Europe’s labor market realities. In light of Europe’s declining working age population, persistent labor and skills shortages are likely to exacerbate. Accordingly, the working age population (20-64-years-olds) is projected to decrease from 265m in 2022 to 236m by 2050. Notably, sectors such as transport and construction, both critical for the build-up of clean tech projects, are confronted with particularly high replacement needs for older workers. In response, the EU must adopt a strategic and selective approach, setting indispensable priorities.

To meet Europe’s climate commitments in full, it is imperative to pull enough skilled workers into jobs related to the deployment of clean technologies. On the other hand, the EU needs to embrace more targeted green industrial policies compared to global counterparts like China and the United States. Given that the shrinking workforce will compound comparative disadvantages related to high energy prices and relatively low average labor productivity, the EU should concentrate on creating high-quality and productive manufacturing jobs in those clean tech sectors that add value to the reindustrialization of the European economy. This is particularly relevant if the sector is highly innovative and competitive, bears significant job creation potential, or if local production is crucial to the transformation of the existing manufacturing base. Based on our previous analysis, this is more likely to be the case for manufacturing EV batteries and wind turbines than for onshoring solar PV manufacturing.

To realize its green ambitions, the EU must transform its energy sector and its economy on its own terms, acknowledging its unique industrial structures and its limited availability of skilled workers. This requires prioritizing the deployment of clean technologies, and a finer-tuned green industrial strategy. If the EU fails to address the daunting skills and labor challenge, its green ambitions are set to fail as well.

Photo: CC Evgeniy Alyoshin, Source: Unsplash