Energy-intensive industries in the EU are facing two main challenges: high energy prices and transitioning to decarbonised production. However, there is as yet no convincing EU-wide strategy for this sector‘s future. Given that the spectre of ‘deindustrialisation’ has triggered a readiness to act among the member states, there is a window of opportunity for designing such a strategy and putting it on the next Commission‘s agenda. This strategy must go beyond lowering energy prices, and factor in that cost pressures on industry to relocate will persist even in the long run, that the economic and resilience value of domestic production is lower than often portrayed, and that industrial decarbonisation is not just an EU but a global must. This policy brief delves into the economic, resilience and climate dimension of supporting energy-intensive industry, aiming to colour in contours of a potential strategy, and suggesting initial policy steps the EU should take.

For a full version of this Policy Paper including the footnotes, please download the PDF above.

1. Introduction

Nearly two years after the Russian invasion of Ukraine triggered an energy crisis, the EU has still not developed a convincing strategy for energy-intensive industries. The national and EU policy measures enacted in 2022 were reasonably successful in managing gas shortages and cushioning the immediate impact on households and the economy. But beyond this crisis response, no proper strategy has been developed for energy-intensive industries, neither by member state governments nor the EU itself. Given the challenges energy-intensive industries face – chiefly high energy prices and the green transition – such a strategy is vital.

A sound strategy for energy-intensive industry must go beyond lowering prices and take into account relative changes in structural energy prices, as well as the need to decarbonise industry globally. While wholesale electricity and gas prices have normalised from their massive peaks in summer 2022, they remain high and are expected to stay higher than in other world regions. For highly energy-intensive industries in the EU, these elevated prices may threaten their survival and industry associations have been ringing the alarm bells. However, simply focusing on lower prices is not the answer, for three reasons.

First, current EU industrial hubs face higher energy costs both now and, critically, even over the long run. Given that the economic value of domestic energy-intensive industry is likely to be more limited than often portrayed, subsidies to keep industries going in their current location might be bad economics, pure and simple. Second, support for industrial decarbonisation is crucial to reach climate targets, and must eventually happen internationally, not just in the EU. By actively managing the re-location of some energy-intensive industry to third countries, the EU could simultaneously strengthen its geopolitical position and boost decarbonisation efforts globally. Third, while a small number of energy-intensive products might be important for EU resilience and security, this would at best justify very targeted support, not across-the-board subsidies. EU policy for energy-intensive industries must take these three considerations into account.

Given the spectre of “EU de-industrialisation”, many member states want to support energy-intensive industries, opening a window of opportunity for the next EU Commission to help steer any support in the right direction. Policy makers widely agree that the most important lever for helping industry consists in reducing energy prices horizontally, including by increasing the supply of clean, cheap energy. This will rightly continue to feature prominently on the EU agenda. But beyond that, disagreement and analytical uncertainty prevail on what kind of targeted policy intervention is needed. This policy brief delves into the economic, resilience and climate dimension of supporting energy-intensive industry. It aims to help structure and stimulate the debate required now before the EU elections of June 2024, paving the way for action by the next Commission. Finally, it gives some initial suggestions as to what EU policies are required.

Box 1: Which EU industries are ‘energy-intensive’?

There is no set of manufacturing industries officially defined as ‘energy-intensive’, but the metric typically used for delineation is a sector’s energy use, relative to its value-add. If this metric is applied to economic activities as categorised in the NACE-2 system, the five most energy-intensive areas within the manufacturing sector are: chemicals and chemical products (C20), coke and refined petroleum products (C19), basic metals (C24), and ‘other non-metallic mineral products’, such as glass, cement, or clay (C23). In this policy brief, area C19 (coke and refined petroleum products) is omitted in charts and averages since this sector has low value-add and will be phased out in line with climate efforts. Hence, following other policy research such as a recent Bruegel paper, NACE-2 activities C17, C20, C23, and C24 are used to denote ‘energy-intensive industries’, unless otherwise specified. They account for about 14% of total greenhouse gas emissions, for about 2% of GDP, and for about 2% of total employment in the EU.

2. Energy-intensive industries are facing multiple headwinds

EU energy-intensive industries are facing a number of challenges, with high energy prices the most pressing. At their peak in summer 2022, wholesale gas prices were 10 times higher than in 2020 (TTF). EU natural gas is expected to stay significantly more expensive (around 2x) than for instance in the USA. EU electricity prices were 121% higher in 2022 than in 2021 (European Power Benchmark), with peaks of > €400 /MWh. Given policy measures, hedging strategies and multi-year contracts, companies have not been fully exposed to the rise in wholesale prices, but are nonetheless paying much higher prices than before.

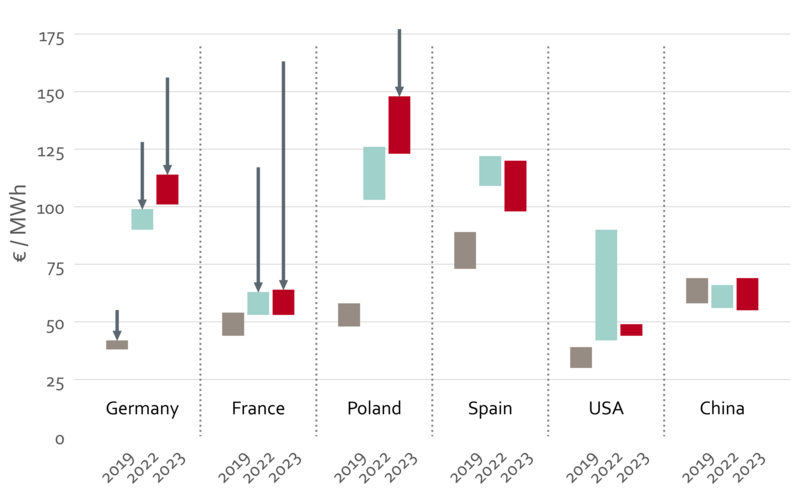

Figure 1: Electricity costs for large industrial companies

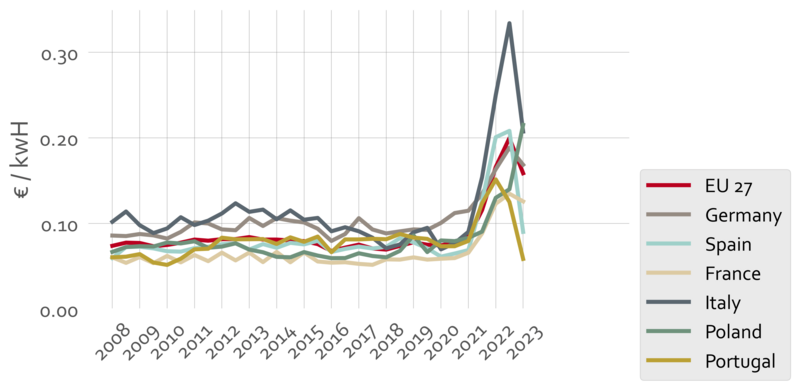

Figure 1 shows the estimated electricity costs for a large industrial company in six different countries, taking into account price support mechanisms in EU countries. The cost difference between EU countries on the one hand, and the USA and China on the other, has widened significantly for large industrial companies in 2023, and is currently only contained by the price reduction mechanisms (such as ARENH in France). Figure 2 shows electricity prices for the EU for the second-largest group of energy-intensive companies (defined as having annual consumption of between 70k and 150k MWh). For these companies, prices seem to have increased more strongly in 2022, before going down more steeply, compared to the largest companies shown in figure 1. While there are large variations across countries and firm sizes, the overall picture is clear: energy has become significantly more expensive for EU industry.

Figure 2: Electricity costs for non-household consumers, with annual consumption of 70k-150k MWh

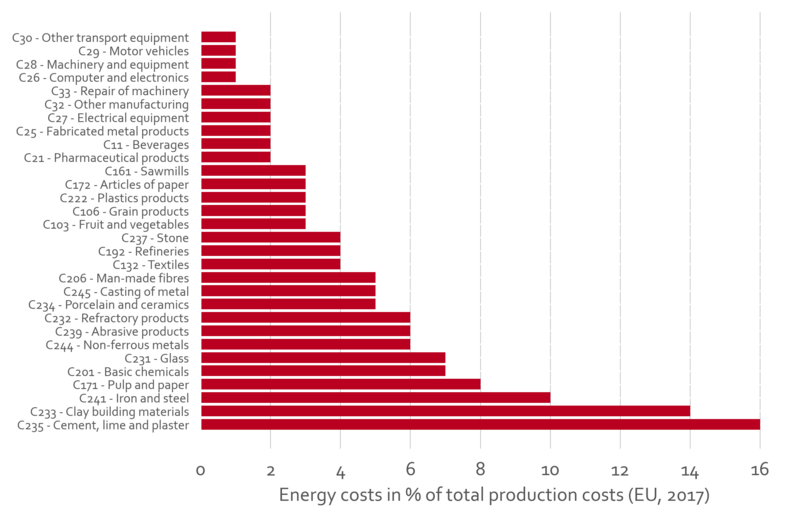

For most companies, energy prices are not a driving factor when it comes to their business viability. The share of energy costs relative to total costs is typically only between 2% and 5%. For a company where energy is 2% of total costs, a doubling of energy prices (corresponding roughly to the average EU electricity price increase from 2019-2023 shown in Figure 2), would increase total costs by 2%. While a 2% cost increase is not inconsequential for profit margins, changes in the remaining ~96% of costs will typically be much more important. Moreover, companies that are not in international competition can usually pass on energy price increases to the customers.

However, for other companies, energy costs do constitute a large proportion of total costs. Figure 3 shows this ratio for a selection of manufacturing industries (in NACE-2 or NACE-3 granularity). For some individual products, such as zinc and aluminium, the share is even higher, at around 50% and 40%, respectively. For these industries, high energy prices do pose a problem, especially if they face international competition along with little product differentiation and low profit margins.

Figure 3: Energy cost share for selected manufactured products

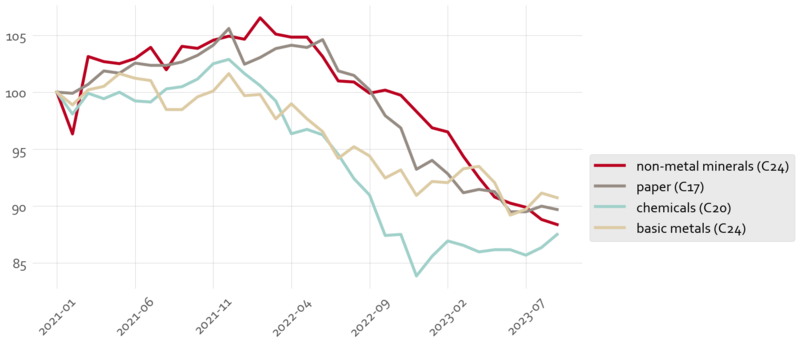

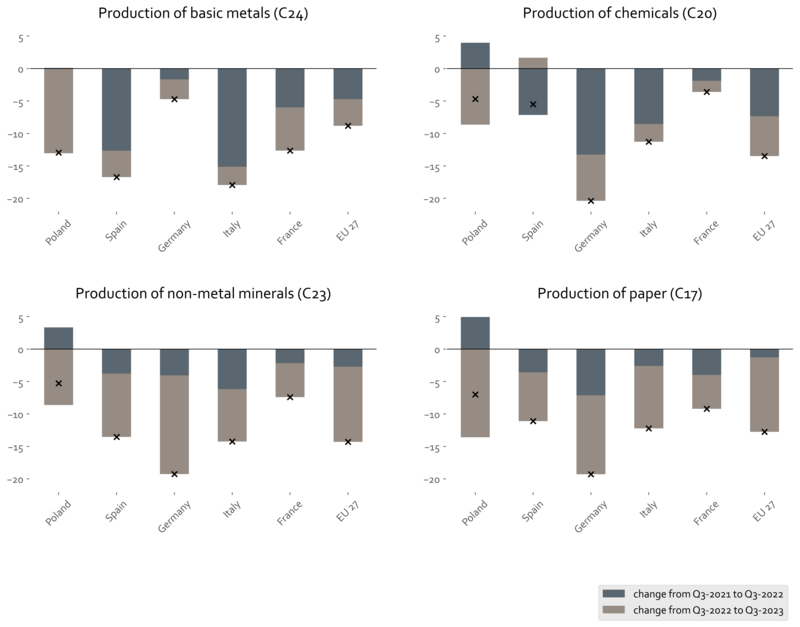

High energy prices have badly dented production in energy-intensive industries. While overall industry has so far weathered the storm fairly well, production in energy-intensive sectors has declined steeply. Figure 4 shows the decline in the total EU manufacturing of paper (C17), chemicals (C20), certain non-metallic mineral products such as cement, glass, lime, or concrete (C23), and basic metals (C24). Compared to early 2021, by end of Q3 2023, production had decreased by at least 10% in each.

Figure 4: EU total production of energy-intensive industries, indexed to 100 in Jan-2021

The decline in production is even more pronounced at a national level for some industries. As shown in figure 5, production in the last two years has declined in all countries in all four sectors considered. However, the trajectory differs substantially between countries. For instance, the index for chemicals output went down by almost 20 points (i.e. roughly 20%) in Germany, but by less than five in France. On the other hand, Germany’s production of basic metals declined only a little in the last two years, whereas in Italy it plummeted by almost 20 points.

Figure 5: Change in production of energy-intensive industries in the last two years, at national level

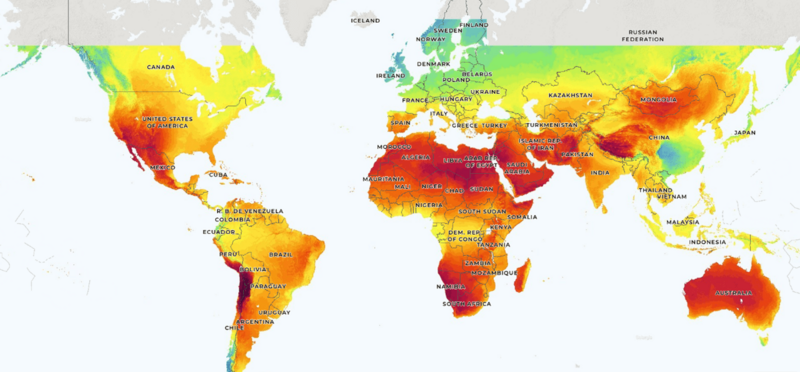

Beyond the energy price shock induced by the Russian invasion, energy costs for industry will likely remain high long-term. Today's political focus is mainly on mitigating the current price shock. However, for investment decisions and the industry's future, long-term price expectations are crucial. Assuming that climate efforts are not abandoned, in future industry will be powered mostly by clean energy. One key determinant for its cost will be the geographical potential for producing renewable energy, which is not optimal in most parts of Europe, compared to windier and sunnier climes. Figure 6 shows that solar potential (darker shades indicating higher potential) is much better e.g. in Australia, parts of Africa and/or parts of Central and South America. Europe’s wind energy potential stacks up slightly better in international comparison, but there are still many locations much better suited for large-scale wind energy harvesting. Moreover, given that levelized costs of nuclear energy are expected to remain too high to compete with solar and wind, it is unlikely to substantially change the cost differences between the EU and third countries. Consequently, it is estimated that current industry hubs in the EU will face higher energy costs than overseas rivals, even in the long term.

Figure 6: Solar energy potential

CO2-prices and transitioning to clean production processes are another cost driver for energy-intensive industry. While the price trajectory of EU CO2-certificates is unclear, it is expected to increase substantially in coming years. Moreover, so far, EU industry has received certificates for free, but with the phase-in of CBAM, the free allocation of certificates will gradually be phased out. Currently, many electricity-intensive companies also get compensation for any indirect CO2 costs they incur when purchasing electricity, but these could well be tapered in future. Consequently, carbon costs will rise for energy-intensive industry, if their production emits CO2. The desirable alternative, namely the switch to clean production processes, would avoid CO2-prices, but comes with higher investment and operating costs. Producing clean steel, for instance, has high investment costs for building new types of production facilities as well as high operating costs, given the high price of clean hydrogen. Hence, clean steel and other energy-intensive products will continue to be more expensive than their fossil alternatives, even after taking into account that CO2-prices narrow the difference.

Overall, today's European energy costs are much higher than elsewhere, and while the difference is going to decrease, this will take time, and a significant cost differential will persist even in the long term. Additionally, EU industry faces higher costs for the green transition than many other countries, given that the latter are less ambitious towards greening their industry, and many of them (like the US) pursue a policy mix tilted towards subsidies rather than CO2-pricing.

- Potential justifications for targeted support for energy-intensive industries

Whether and how policy makers in the EU should respond to the challenges described above is still an open question. Changes to the composition of the economy will not necessarily prove detrimental to prosperity, so the argument for keeping energy-intensive industry going with costly subsidies must be strong. There are at least three distinct possible justifications for targeted policy support. First, the value (direct and indirect) of energy intensive industries for the overall economy. Second, if the manufacturing of some critical energy-intensive products is not profitable in the EU, subsidies might be justified on resilience grounds. Third, benefits for climate, to the extent that support triggers a cost-effective switch to green production processes or lowers the global cost curve. Typically, advocates of financial support allude to all three reasons, but clearly distinguishing between them is necessary to determine whether support is sensible, and if yes, how to design any support schemes to achieve the objective at hand. In the following, the three dimensions are briefly investigated in turn.

Economic objectives

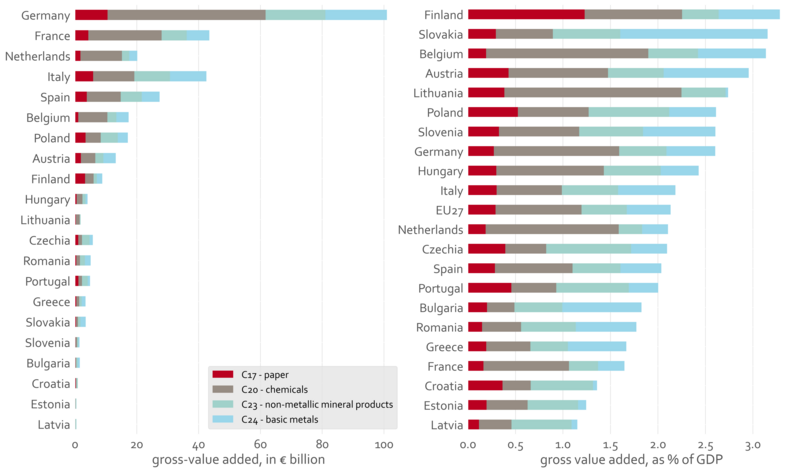

Industry associations typically emphasize the economic importance of energy-intensive industries. However, their direct economic effect is rather limited. The gross value added for the paper, chemicals, non-metallic mineral products and basic metals industries together account for about 2% of EU GDP. They similarly make up roughly 2% of total employment. Given the massive volume of subsidies proposed in some countries, this economic footprint is small, especially compared to their massive energy use, which is over 60% of industrial gas demand, and over 50% of industrial electricity demand.

Figure 7: Value-add of energy-intensive industries

Consequently, the debate often emphasises the indirect economic value, i.e. energy-intensive industries’ importance for other domestic industry downstream in the value chain. According to this argument, domestic energy-intensive production helps make industry generally flourish. However, if this argument is to hold, there need to be strong cluster effects. Otherwise, companies downstream in the value chain can simply import energy-intensive products from abroad. So far, there is very little empirical evidence on cluster effects (c.f. study by Dezernat Zukunft, or Valle 2020), and more research is needed. However, the burden of proof should be on energy-intensive industries: If they call for subsidies based on the indirect economic value they supposedly create, they need to show that these cluster effects exist. Without such evidence, it should be assumed that domestic production can, in most cases, be substituted with cheaper imports.

Resilience objectives

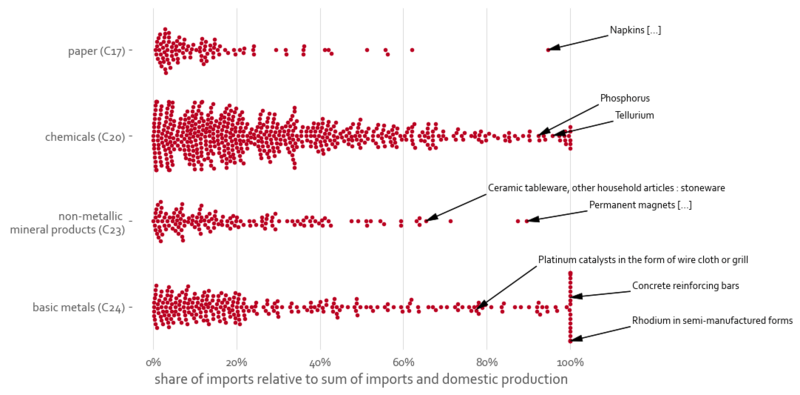

Another possible justification for targeted support is the importance of some energy-intensive products for EU resilience, i.e. avoiding the risk of supply disruptions or shortages. However, only a small fraction of energy-intensive products arguably meets this criterion. For most products, if EU domestic output decreased, the resilience risk would be low, because the EU would not be overly dependent on supply from a single country. What's more, the number of potential suppliers will likely rise in future, as regions endowed with abundant clean energy will tap into their potential and start producing energy-intensive products.

Figure 8 depicts the situation today, showing the relevance of EU imports for energy-intensive products (as a share of imports and total production). For most paper products (like napkins, which are mainly imported already), there is arguably no security or resilience risk. In the other energy-intensive industries, some high imports might be cause for concern, e.g. for some chemicals, or for metals needed in the defence industry or for the clean transition. However, for products for which resilience could be an issue, domestic production is sometimes not feasible (e.g. because the raw materials needed as inputs are not mined in Europe), or prohibitively expensive compared to diversifying import sources. A more in-depth analysis of the individual products would be needed to identify their resilience risks, in case EU production decreases. If such a granular examination is considered to be analytically too difficult to be feasible, the way forward should be no support, rather than across the board subsidies based on spurious ‘resilience’.

Figure 8: Importance of imports for energy-intensive products in 2022 for EU-27

Climate objectives

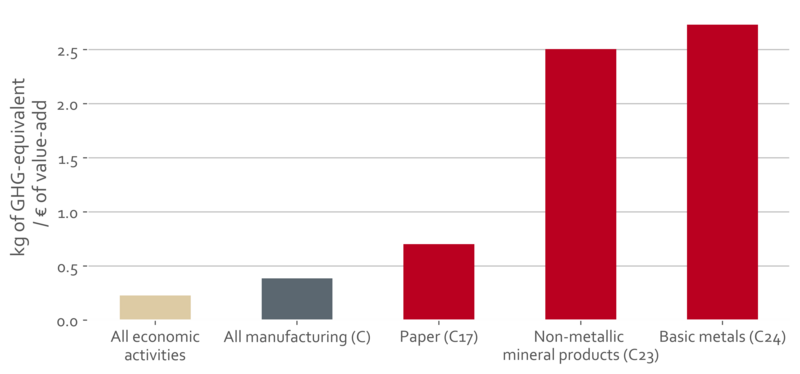

Energy-intensive industries emit massive amounts of greenhouse gasses and greening them will be essential for reaching climate targets. Manufacturing overall is responsible for about 24% of total EU emissions, with just the four energy-intensive sectors accounting for roughly 14% of that total. Figure 9 shows the respective emission intensity, i.e. the amount of greenhouse gases emitted per Euro of value added, which is drastically higher for energy-intensive industries than for the rest of the economy. For most manufacturing, a CO2-neutral production process already exists and has been proven to work at scale or in pilot projects, including for energy-intensive industries. However, the costs for clean production are still significantly higher than the fossil alternative, rendering most projects economically unviable without subsidies.

Figure 9: Emission-intensity of energy-intensive industry in comparison

Because climate targets must be achieved globally, the EU strategy for decarbonising energy-intensive industry must entail three key considerations about the international dimension. First, the EU is more ambitious towards decarbonising industry than other regions, so a shift of production from the EU to other parts of the world could increase global emissions, if no additional precautions are taken. This risk is exacerbated by the fact that even fossil-based production is cleaner and more efficient in the EU than the global average.

Second, in many parts of the EU, clean and cheap energy will be relatively scarce even in the long term (see section 2). Producing energy-intensive clean products in EU regions where energy is scarce will not only be more expensive, but ceteris paribus also take away clean energy from other areas that are non-tradeable and need to be decarbonised (such as household heating or mobility). As such, there are clear climate advantages in producing in regions with more abundant clean energy, instead of in the current EU industry hubs. Hence, from a climate perspective, long-term relocation should be supported both within Europe, and from Europe to renewables-rich third countries, at least in some cases. Third, subsidies in the EU for clean production processes can depress global cost curves, which will help poorer countries to adopt clean production in future.

- Which EU policies for supporting energy-intensive industry?

The EU strategy for energy-intensive industry needs to take into account climate, economic and resilience aspects. Given that most decisions on industry are taken at national level, the scope for the EU level to shape the overall policy direction on energy-intensive industry is limited. Moreover, existing EU funds are increasingly tight, and the political appetite in member states to pool resources to undertake common industrial policies is low, including for energy-intensive industries. Nonetheless, the EU can and should take a number of steps that help navigate the economic, climate and resilience dimension of policy support for energy-intensive industries.

First, the EU is the right level to assess and manage the resilience risks associated with potentially declining EU output of energy-intensive products. Since high energy prices might cause some energy-intensive companies to reduce or cease operations in the EU, the Commission should be tasked to determine whether this threatens resilience. For this, a relatively granular stock-taking of the energy-intensive industry and the various products should be conducted, including on import dependency and business viability. Such an analysis will likely evidence a low resilience risk, so actively managing and diversifying import sources should suffice.

If the analysis instead reveals a resilience risk for some products that market forces alone will not remedy, the Commission should compile for each product the minimum EU production capacities that would reduce the supply risk to an acceptable level. EU funds would then need to be made available via a suitable subsidy scheme, to ensure these production capacities are maintained. For instance, the Commission could auction off production subsidies in an EU-wide auction, to companies committing to keep producing certain quantities in the EU.

Second, the Commission should develop a strategy for demonstrating how relocating energy-intensive industries can yield economic and climate benefits, while simultaneously strengthening the EU’s geopolitical position. As shown above, the economic relevance of energy-intensive industries is smaller than often portrayed. Especially in regions with high energy costs, profits and value-add will be low, or even negative. Consequently, the economic impact on a region that loses some energy-intensive industry is often small, also considering rather tight labour markets. On the other hand, relocation within Europe can have strong climate benefits (see above), while proving beneficial for the EU economy as a whole, given lower overall costs.

Moreover, the EU is trying to improve its geopolitical standing by intensifying its cooperation with third countries, including with those that are renewable-rich, for instance in Africa. The EU typically aims to import renewable energy in the form of hydrogen or ammonia from them. However, an economically more attractive option for those countries would be to produce some of the energy-intensive products and export these rather than energy. Given the climate benefits, and the limited economic drawbacks, the EU should more often offer to help those countries set up their clean manufacturing industries in exchange for e.g. stronger trade ties on critical raw materials or trade guarantees on basic clean products. Such an approach would help increase the share of clean production globally, which is urgently needed. By developing a strategy on this and pointing out the benefits of relocation, both intra and extra-EU, the Commission would also help re-focus the national debates, which tend to exaggerate the drawbacks of losing some energy-intensive industry, and lack any EU perspective.

Third, the EU Commission should closely monitor national state aid, restricting subsidy schemes unless they substantially boost climate efforts. Given that the energy consumption relative to the value-add of energy-intensive products is very high, subsidising their energy prices might not be a smart economic choice for the country as a whole, especially if on prolonged basis. However, if member states insist on going ahead, the subsidies will still benefit domestic companies, creating a distortion in the single market at the expense of companies located in countries with less spending power. At the same time, subsidies in one country have potentially large, positive economic spill-overs to other countries, given the interconnected nature of the EU manufacturing sector. Assessing whether these positive effects outweigh the negative distortions would be very difficult for DG Competition. However, the positive externalities significantly increase if the scheme simultaneously boosts climate efforts. Hence, DG Competition should, as a rule, only approve national schemes if they include strong green conditionality (such as concluding renewable PPAs, for instance). Given the rather lax state aid rules at the moment, this might require some targeted tightening.

Fourth, the EU should continue its financial and regulatory support for the decarbonisation of energy-intensive industry. With the ETS and various decarbonisation subsidies, the EU already has multiple effective policies in place that facilitate industry's transformation. However, additional efforts are needed to reach the highly demanding EU 2030 climate targets, including for some of the ‘hard-to-abate’ energy-intensive industries. First, the EU needs to further accelerate the transition to clean electricity generation, despite recent progress. In addition to levers like the electricity market reform and faster permitting processes, this will also require new EU funds, especially for countries that are fiscally more constrained. For this, finding a successor to the funding from NextGenerationEU, which ends in 2026, will be crucial, as will agreeing on fiscal rules that allow sufficient national green spending. Second, the EU should strengthen the demand side for green energy-intensive products, for instance by mandating increasing percentages of products that are emission-neutral (for instance, public buildings should be required to be built with clean cement and steel). Third, EU funds, which provide decarbonisation subsidies for energy-intensive industries (such as the Innovation Fund), should be used predominantly for decarbonisation efforts, rather than pivot to other industrial policy objectives, like reshoring clean tech manufacturing, whose benefits are less clear-cut. Fourth, the EU should ensure that the existing Fit for 55 framework is not watered down, despite growing political opposition to climate measures. When it comes to energy-intensive industries, it is crucial that the ETS is maintained, with the CBAM implemented and later expanded, and that the free allocation of certificates to industries is phased out as planned.

5. Conclusion

Big changes lie ahead for the energy-intensive industries, and they must happen on a historically swift timeline. Agreeing on a path forward is politically complicated because the optimal strategy hinges on answering two fundamental policy questions: how far can EU energy policy succeed in lowering prices to internationally competitive levels, and does the EU’s future economic model still need a similar amount of energy-intensive industry for it to prosper? Different political parties give different answers to these two questions, so member states will pursue somewhat different paths. But by following the recommendations sketched out above, the next Commission agenda can set a north star, ensuring that policy measures on energy-intensive industry help not just the companies, but are aligned with wider EU climate, resilience and economic objectives.

This policy paper is part of the “Visions for Europe” series that develops longer-term visions and recommendations for different EU policy areas. It is based on extensive consultation with experts and stakeholders from the national and European level, including a closed workshop held in November 2023 in Berlin. The views and opinions expressed in this policy paper are solely those of the author.

Photo: CC Christopher Burns, Source: Unsplash