The “Franco-German Engine” currently stutters more than in the past, especially on energy topics. At times, this obstructs urgently needed policy making at the EU level. This policy brief attempts to illuminate the differences and commonalities between Germany and France on EU energy policy. First, it provides an overview of the German and French energy landscapes and their future objectives. Second, it describes the German and French positions on four controversial energy policy areas: nuclear energy, grid expansion, electricity market reform and guaranteeing low prices for energy-intensive industry. For each area, it identifies the key Franco-German pain-points and opportunities for the way forward.

1. Introduction

Germany and France have been clashing recently over EU energy policy. The two governments have strong disagreements on various files, often over the role of nuclear energy, but also on the purpose of energy markets or suitable emergency measures to cushion the impact of high energy prices. While some disagreement is to be expected and historically has sometimes even been helpful, the intensity of the Franco-German dispute on energy is new and counterproductive. Although the agreement of the EU’s two largest member states is no longer sufficient to command a majority, it typically remains a necessary condition for major EU policy development. As such, the pair’s inability to better align their positions is hampering progress on key EU energy files.

Only some of these disagreements are rooted in structural techno-economic differences between Germany and France. Absent ideological differences and political symbolism, many of the conflicts on energy issues are in fact quite manageable. This is because Germany and France are fully aligned on higher-level energy objectives. Both countries agree on reaching climate neutrality as quickly as possible, in a secure and affordable way. They also are aligned on most of the key levers and instruments to reach those objectives (except for the role of nuclear energy). Consequently, underneath the public disputes, there is a lot of common ground on which to build.

Pragmatism should rule Franco-German relations on energy policy. Accepting their differences where they do exist and dealing with them in a non-ideological manner will allow the German and French governments to focus on the many similarities of their countries’ energy challenges. They can collaborate more effectively on the four policy areas discussed in this policy brief: Regarding nuclear energy, they need to recognise that member states’ right to decide their energy mix entails accepting different approaches in the EU. Conceptual differences must also not delay quickly needed improvements in the electricity market reform, obstruct support for energy-intensive industry, nor hamper the expansion of energy grids. Since Germany and France often represent two ends of the spectrum on energy topics finding common ground between Germany and France will also go a long way to facilitate an EU majority on legislation.

2. The current energy landscapes in Germany and France

Franco-German disputes over energy policy occur increasingly often because of three reasons. First, the energy crisis and climate change necessitate more joint EU action, making the differences between Germany and France more visible. In other words, the fact that disputes have increased recently does not necessarily indicate that their positions are moving apart, but reflects that France and Germany have difficulties overcoming long-standing differences in times when greater alignment is necessary. Second, the questions surrounding nuclear power in particular are emotionally-charged (especially in Germany, including for historical reasons), making them a focal point that often puts them front and centre, diverting attention away from similarities in other areas. Third, despite the many similarities, there are of course some material differences that make alignment more difficult in some areas. This section explains where France and Germany's current energy situations and challenges are similar, and where they have important differences.

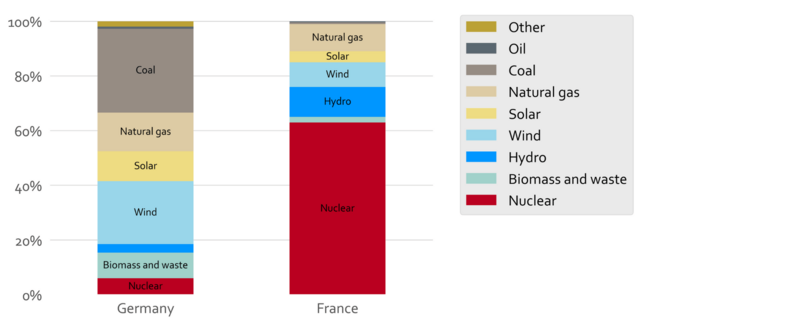

It is often assumed that structural differences between Germany and France underlie the current disagreements. However, these differences are typically overstated. The main difference is the current electricity mix. France’s mix is characterised by a high share of nuclear, whereas Germany has high shares of coal and renewables, as shown for the year 2022 in Figure 1 below. Since Germany shut down its remaining nuclear reactors in April 2023, and reactors under repair last year in France have come online again, the differences on nuclear might become even starker in 2023.

Figure 1: Electricity Mix in 2022

However, differences in today’s electricity mix do not tell the full story for two reasons. First, in the coming years, the share of solar and wind will increase massively for both Germany and France, and this will have the largest impact on the electricity mix, notwithstanding the French plans to build new nuclear capacity. Since total electricity demand will quickly rise, new nuclear capacity will almost certainly not satisfy all of it, and hence renewables will fill much of the gap in France as well. Overall, this implies that the share of nuclear will likely fall in France. Consequently, while nuclear electricity does constitute a substantive difference in the electricity mixes of Germany and France, these differences will shrink in the future.

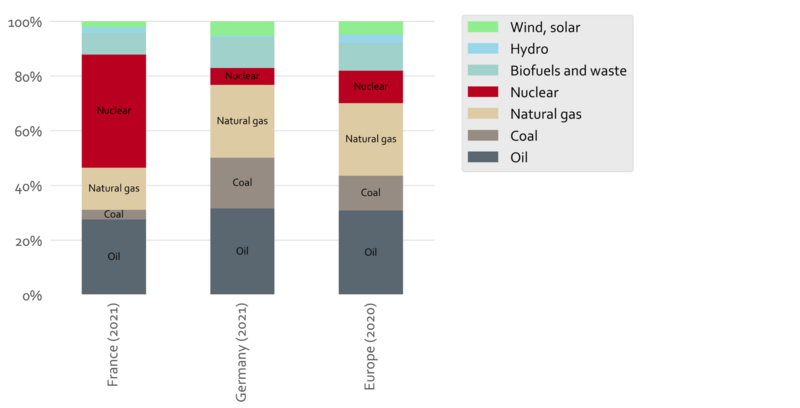

Second, electricity is a small part of total energy used today. When considering energy supply by source, as shown below in Figure 2, the differences between France and Germany become less extreme than when considering electricity alone. Decarbonising the whole energy supply will take enormous efforts which will be similar in Germany and France. Importantly, these efforts will not end with greening the electricity mix, but include wider transformational efforts such as changing heating systems, switching to other vehicle types, renovating buildings, changing industrial processes, et cetera.

Figure 2: Total Energy Supply by Source

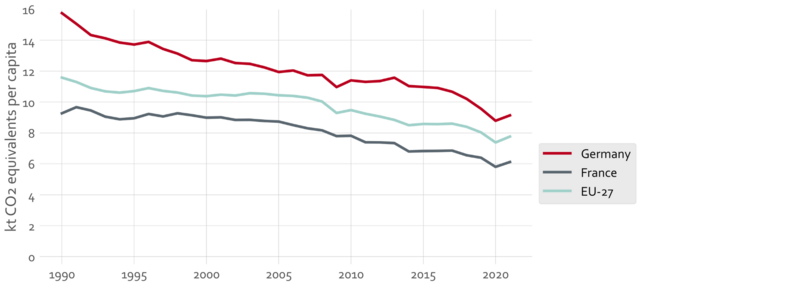

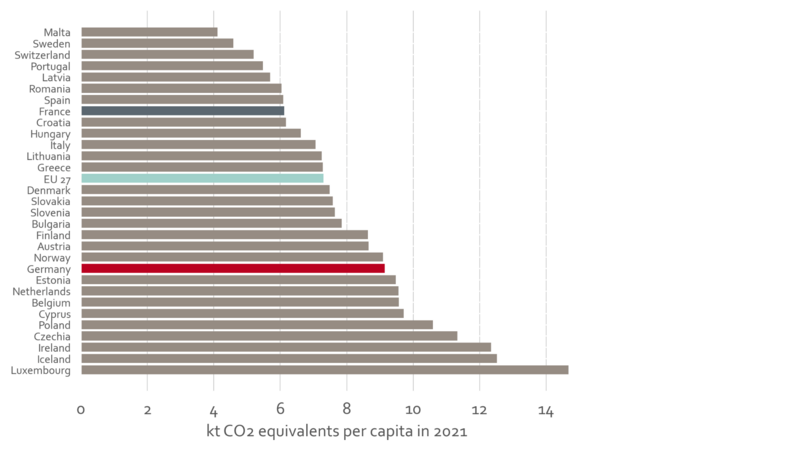

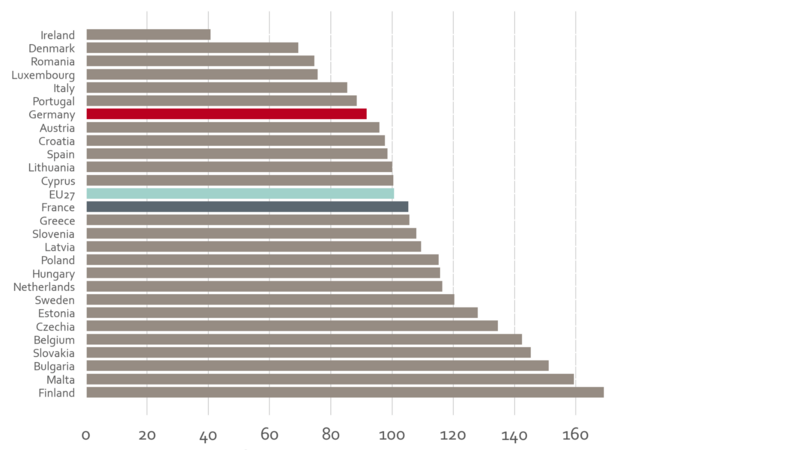

Regarding emissions, the similarities between France and Germany also outweigh the differences. With about 6 tonnes of greenhouse gases per capita, France had lower per-capita emissions than Germany (9 tonnes) in 2021. While France is below the EU average, Germany is above it (see Figure 3). However, differences in emissions today should not be over-interpreted, since they are almost insignificant in comparison to the monumental task of reducing net emissions in both France and Germany to zero.

Figure 3: Greenhouse gas emissions per capita

3. French and German stances on selected key energy files

Despite these similarities, Franco-German conflict over energy is hampering EU progress on key issues. This section discusses four crucial energy policy areas, outlining where Franco-German disagreements arise from material differences, and where the French and German positions are actually closer than often thought. Where possible, it sketches a possible way forward and identifies areas of potential Franco-German collaboration.

3.1 The role of nuclear energy

Disputes over the role of nuclear power are one of the evergreens of Franco-German disagreements over energy. At the EU level, provisions relevant for nuclear power permeate all sorts of energy legislation, including those that predominantly concern other issues. Technically, the EU cannot take decisions on member states’ composition of energy mixes. However, to reach energy objectives which do fall within the EU’s area of competence, many pieces of EU legislation favour some energy sources over others, with large ramifications for the (un)favourability of nuclear. This puts EU nuclear policy in a difficult spot: since there is no fundamental alignment on this issue (which is also not envisioned in the treaties), these controversies pop up on each and every file with provisions that impact nuclear.

France and Germany tend to be on opposite sites on files with links to nuclear, and this has negative repercussions for areas that are relatively uncontroversial. For instance, both Germany and France (and most of the rest of Europe) agree on the important future role of hydrogen. However, disagreement over nuclear and lobbying by the German and French governments caused a delay of a Delegated Act that defines the conditions under which hydrogen, including nuclear-based hydrogen, can be labelled “renewable” and enjoy favourable treatment in the EU. This lost valuable time to kick-start the overall hydrogen market since companies waited for regulatory clarity before making final investment decisions. Table 1 lists this case as well as other instances in which questions on nuclear had negative impact on other, much less controversial files.

Table 1: How nuclear permeates EU energy legislation

The French and German visions for the role of nuclear will not align anytime soon, but this disagreement should not block progress towards other energy objectives that are less controversial. With two complementary approaches, EU energy policy making could become faster and less complicated: First, questions on nuclear should be disentangled from other energy questions in EU legislative proposals wherever possible, ideally reducing the number of policy files with implications for nuclear. To pick one example: the NZIA proposal to accelerate planning procedures for clean tech manufacturing could move forward more quickly if the question which technologies benefit (i.e., also nuclear) were negotiated separately, or left to the discretion of member states. Second, in negotiations over files in which such a disentanglement is not possible, governments should refrain from trying to constrain or boost nuclear power through the backdoor in other member states. In other words, the fact that EU countries decide on their own electricity mix means that nuclear should not receive favourable or unfavourable treatment just by virtue of being nuclear. Instead, EU rules should provide a level playing field on which nuclear and renewables (and potentially other energy sources) compete on their merits, namely their cost, safety, carbon intensity, value to the electricity system, environmental footprint, societal acceptance, et cetera. To give one example: this means that treatment of hydrogen under EU rules should be based primarily on its carbon footprint, and not whether it is nuclear- or renewables based.

3.2 Energy grid infrastructure

Energy grid infrastructure in all of Europe must be expanded quickly. With the energy transition and the electrification of the economy, Europe’s electricity demand will quickly rise, supply will be more volatile and will be generated in other locations than before. This will only be manageable with additional and reinforced electricity grids. Additionally, the EU’s ambition to use 20 million tonnes of renewable hydrogen by 2030 (half of it imported from non-EU countries) requires building new pipelines and repurposing parts of the existing gas grid. While most updating of energy infrastructure must be done within EU countries, there is also a strong and increasing need for EU cross-border infrastructure. While Europe already has the world’s largest connected grid, in the next 10-15 years, interconnections must double to fulfil the “system needs”, i.e. be at the economically efficient level. While additional electricity cross-border connections are being planned, there remains about a 20% gap (~15GW) between planned projects and system needs for 2030. For Germany and France specifically, the gap is smaller, but still exists (and could get much bigger, if some planned projects are not realised, or not realised quickly enough). At present, hydrogen pipelines barely exist at all. Since infrastructure projects take a long time to plan and build in Europe (5-13 years for extra-high voltage lines), the time to start planning them is now.

Germany and France have divergent visions for future energy infrastructure. The German government recognises its low renewable energy potential and is therefore planning to import large amounts of energy, especially hydrogen. Imports would in part come from southern Europe, including Spain and Portugal, and pass through France, which will require additional interconnections. While Germany is having severe difficulties building grids at the necessary speed, it does intend to build a lot of it. France on the other hand appears somewhat more reluctant: While the status quo of French electricity interconnections and those already under construction looks relatively solid, the expansion after 2025 is less clear, and on hydrogen pipelines France is dragging. This can partially be explained by the associated financial cost (infrastructure is expensive) and political cost (citizens objecting to grids in their vicinity), which apply in all countries. However, another important factor is France’s emphasis on energy sovereignty. It places inherent value in producing most of its energy domestically, which is in line with its bet on nuclear. The Franco-German differences on cross-border infrastructure were recently on full display over a hydrogen pipeline project from Spain via France to Germany, which Germany called for and which France vehemently opposed. While this particular dispute has been overcome, the different views on additional energy connections, in particular hydrogen, remain.

However, France will also benefit from EU-wide expansion of cross-border infrastructure, including with Germany. Regardless of the future role of nuclear, renewable electricity capacity will still increase significantly in France (as discussed above). Given the volatile generation profile of renewable energy sources, better energy-connectedness with further-away regions and countries can smooth out generation spikes (other types of flexibility, like storage, will become cheaper, but likely remain more expensive than transmission). Moreover, if France’s nuclear strategy is a success, France could make large profits by selling electricity and nuclear-produced hydrogen to Germany and the rest of the EU during prolonged periods of little sun and wind.

Despite some of the latest political disputes, France and Germany thus share a broad interest in an heavily extended and upgraded European energy grid infrastructure. The French government in particular needs to realize that energy sovereignty will only work in a European framework. Consequently, French policymakers should give higher priority to cross-border infrastructure, including on hydrogen, not use infrastructure as a bargaining chip, and push for decisive EU-wide grid expansion together with the German government.

3.3 Electricity market reform

Germany and France have different visions of how energy markets should function. Franco-German differences with respect to market design became apparent when EU energy emergency measures were negotiated last year. While Germany was in favour of keeping price signals intact as much as possible to avoid acute energy shortages, France was in favour of stronger state intervention to reduce prices. This can partly be explained with material interests: given its small LNG import capacities, Germany needed to purchase pipeline gas from its European neighbours. Without a functioning market allocating gas to the highest bidder, Germany might not have received sufficient gas quantities last winter. However, in addition to these material interests, different economic traditions and ideologies also contributed to divergence of Franco-German viewpoints. With the crisis having subsided, these differences are now becoming visible again in the negotiations on the electricity market reform (EMR), where disputes between Germany and France again hamper progress.

Some Franco-German disagreements on EMR stem from material interests, and are typically related to nuclear. For instance, France would like to use “Contracts for Difference” for existing nuclear power plants, using revenues to extend the lifetime of old reactors. This would effectively allow France to heavily subsidise its existing nuclear power plants. Other countries, including Germany, are opposed, citing concerns about distortionary effects on the electricity market. Another problematic area are “gate opening and closure times”, which regulate the intervals of trading on the electricity market. Germany is in favour of short intervals, which better match the volatile generation profile of renewables, whereas France advocates for longer intervals, in line with the more steady output of nuclear plants. Unfortunately, for some of these questions, no easy solutions exist, since the market design option that works well for nuclear is often mutually exclusive with the one that works well for renewables. On these questions, a tit-for-tat seems inevitable for the time being, and pragmatism should rule the EMR negotiations, given the need to find solutions quickly.

However, some Franco-German disagreements on EMR also stem from fundamentally different concepts of what the market should aim to achieve. Despite the fact that the EU electricity market has been working smoothly for a long time (at least before the energy crisis induced by the Russian war), there is no agreement among EU countries on a basic question: What is the purpose of the electricity market? Some countries (or their governing political parties) want to keep the market focused on its primary goal, which is mainly to guide dispatch and investment decisions through prices (i.e, which power plant should operate when, and how much of which electricity source should be built). Other countries instead envision a market that fulfils additional objectives, such as redistributive policies (by capturing “windfall profits”, for instance), or industrial policy (like providing cheaper prices to energy-intensive industries than to other consumers (see section below). On the spectrum spanning between these two poles, France is closer to using the market as a tool to reach various political objectives, whereas Germany tends to be more purist on many issues. However, disputes over the last year have revealed that German policymakers struggle to understand their French counterparts, and vice versa, on some of these conceptual questions.

Consequentially, a high-level exchange of German and French policymakers to better understand each other’s positions on what objectives the market is supposed to fulfil – and for which objectives other instruments are needed – could help to resolve at least some Franco-German disagreements. For instance, this applies to support for electricity-intensive industry: should they be supported by adjusting the rules of the reformed electricity market, or should instead an instrument outside the scope of the electricity market be used? One instrument outside of the EMR scope, a fixed electricity price for industry, is discussed in the next section.

3.4 Guaranteeing low energy prices for energy-intensive industry

While energy prices have come down from record heights of 2022, they remain elevated and pose a problem for some EU industries. For most companies, energy costs are just a small fraction of total costs. But for some energy-intensive industries in the EU, such as glass, steel or paper producers, energy costs are sizeable (e.g. for the steel industry, 10-20% of total costs before the energy crisis). Since EU energy costs are expected to stay substantially higher than in e.g. the US or China for several years, some of these companies will struggle to be cost competitive at the global level. Against this backdrop, some EU countries are contemplating relief measures that extend beyond the acute crisis that resulted from energy decoupling from Russia. There is potential for cooperation between France and Germany in designing such measures, given that their objectives and starting positions are relatively similar. Moreover, there has been no dispute between Germany and France on these matters so far, and collaboration could hence also serve as a sign of a renewed Franco-German partnership on energy topics.

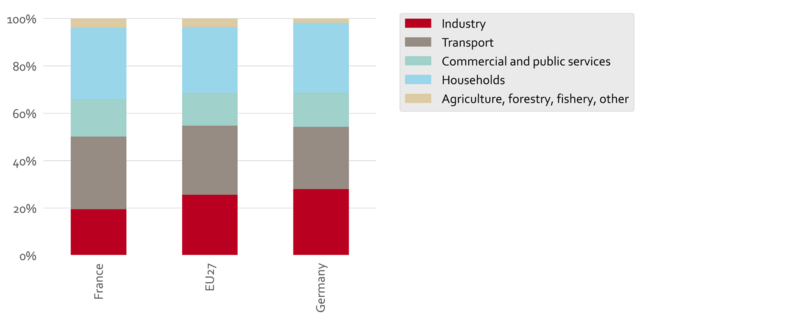

While Germany is more industry-heavy than France, their overall energy needs are roughly the same, and both want to strengthen their industry. Looking at the energy needs of the economy as a whole, Germany and France are quite similar: creating one Euro of value-added requires about the same amount of energy in both countries (see Figure 4). However, analyses focusing on Franco-German differences often highlight that Germany has more manufacturing, for which energy costs are often more significant than in other parts of the economy. Indeed, Germany has a strong manufacturing sector with a value-added of roughly 19% of GDP, compared to only about 9% in France. This is reflected in primary energy use (see Figure 5), showing that Germany also spends a higher share of its energy on industry than France. However, the differences are not that large (28% versus 20%) and more importantly, both countries intend to strengthen their industry going forward. France plans a “reindustrialisation” (France’s 9% manufacturing share stood at 30% in the 1960s), and Germany plans to retain its existing industry as well as to branch out to additional sectors (such as clean tech, or chip manufacturing). Consequently, they both aim to create favourable conditions for industry, including for those sectors with high energy needs.

Figure 4: Energy intensity of EU economies

Figure 5: Primary energy use per sector

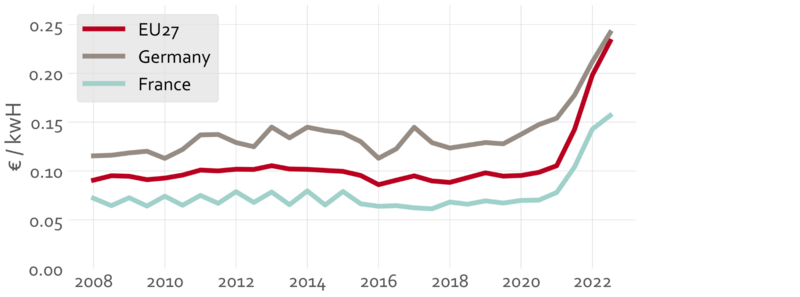

Both countries have identified low energy prices as an important lever for a successful industrial sector. While France has always been open to intervene in the energy sector, parts of the German government are now considering more intervention as well. The German Ministry of Economy has proposed a guaranteed price for electricity of 6ct/kWh for electricity-intensive companies in Germany. This state-subsidised price is intended to be a “bridge” to the time when energy transition and expansion of cheap renewables will have progressed sufficiently to have driven market prices down (the German ministry of economy first proposed 2030 but is now considering 2025, in order to reduce fiscal costs). In the German debate, this proposal is often discussed with reference to France, claiming that France already has an analogous system in place.

However, while France has various support schemes in place, it so far does not support electricity-intensive companies with a targeted scheme during the energy transition period. France used to have a state-set electricity price for industry, but this was lifted in 2016. In the context of the energy crisis and the war in Ukraine, France made direct grants available to energy-intensive industries as a relief measure, which is one reason why prices did not rise that much in France in 2022 (see Figure 6). Moreover, under the controversial “ARENH” (Regulated Access to Incumbent Nuclear Electricity) mechanism, the state-owned utility company EDF must sell certain electricity volumes at cheap prices to other utility companies, which lowers the price for electricity consumers generally However, the scheme is due to end in 2025, and, importantly, does not target energy-intensive industries specifically. Hence, neither Germany nor France have a dedicated system in place yet, and future support for energy-intensive industry could potentially take the form of a new “industry electricity price”.

Figure 6: Electricity prices for large non-household consumers (70k-150k MWh per year)

Reducing the electricity price for industry carries substantial risks. First, if only some countries disburse subsidies to lower the electricity price, it could potentially divert investments from one member state to another, causing distortions within the single market. Second, these schemes could reduce cost incentives to decrease energy consumption and cement the status quo, which conflicts with climate policy objectives. Third, given major shifts and differences in long-term (2030-2045) forecasted energy costs across Europe and the world, some energy-intensive industry will likely not be cost-competitive in the long term if it remains in its current location. To the extent that these schemes only delay inevitable relocation, they may waste taxpayer money.

A European dimension should avoid these drawbacks, and a Franco-German collaboration could lead the way. If both France and Germany decide to pursue an electricity price for industry, they should seize the opportunity to collaborate and align the systems’ designs with the European dimension in mind. If multiple member states were to implement the same scheme the distortionary forces would be reduced. This could entail, for instance, harmonization regarding price level, time horizon, and eligibility criteria. Reducing distortive forces is not just crucial for the sake of the EU, but also necessary to receive state aid approval from Brussels. Moreover, since the scheme would be temporary (until e.g. 2030), its inception should be firmly embedded in national and EU measures intended to ensure that electricity costs go down as quickly as possible (i.e, predominantly expansion of cheap clean energy and grid expansion). Lastly, beneficiary companies should also have an obligation to move towards clean production processes in order to achieve EU climate objectives. Aligning the specifics of these obligations on EU level would also be beneficial, to keep the transformation ambition high across member states, by countervailing country-specific, vested interests of industry. In sum, to reduce drawbacks for the rest of the EU and receive state aid approval, Germany and France could take a joint leading role in proposing the future shape of support for energy-intensive industry.

4. Conclusion

On most aspects that are relevant for energy policy, Germany and France have similar starting positions, and they are almost fully aligned on higher-level energy objectives. Consequently, better Franco-German cooperation is possible on various EU energy files.

On nuclear, a higher level of pragmatism is needed on both sides. The fact that EU countries decide on their own electricity mix implies that under EU rules, nuclear should be neither disadvantaged nor favoured purely by virtue of being nuclear. Instead, EU rules should be designed such that nuclear and renewables compete on a level playing field on their merits (i.e. on cost of electricity, carbon intensity, value to the electricity system, environmental footprint, societal acceptance, et cetera). Moreover, in legislative proposals, nuclear should be disentangled from other, only indirectly-related energy policy questions wherever possible.

On electricity and hydrogen grids, all countries – including France – should be more ambitious, and push to quickly reinforce and expand cross-border infrastructure. More infrastructure is needed than is currently planned, and it is in each country’s interest to build it.

On electricity market reform, Germany and France should strive for better alignment on overarching conceptual questions. An alignment on the objectives that the electricity market ought to fulfil will facilitate negotiations by helping to identify areas for which instruments outside the scope of the market design are better suited (e.g. on some fairness aspects). However, on contentious issues reflective of techno-economic differences, pragmatism will be needed to reach compromises, which will likely entail a tit-for-tat on some issues.

On support for energy-intensive industry, there is potential for increased Franco-German cooperation. Should both countries decide to guarantee low, fixed electricity prices for energy-intensive industry, they should coordinate on the design of such a mechanism. This will help reduce the significant risks, especially with respect to distortions in the single market, and also facilitate obtaining state-aid approval from Brussels.