The EU struggles to remain internationally competitive, with pressures intensifying since the Russian war in Ukraine. Many factors, most of them long-standing, determine EU competitiveness, such as lack of skilled labour, digitalisation, or quality of infrastructure. A vast literature exists on how to address these issues. This paper takes a narrower approach by focusing on three more recent levers for the EU to ensure its future competitiveness: devising an EU industrial policy, adapting to the changing energy landscape, and positioning the EU in a geopolitically tense environment.

This Policy Position is based on a discussion input that was prepared for the 31st Franco-German Meeting in Evian from 7 - 9 September 2023. For the same event, Cornelia Woll, President of the Hertie School, delivered remarks on the challenges of the green transition, which can be found on our website here. Nicole Gnesotto, Vice President of the Jacques Delors Institute Paris and Pascal Lamy, Coordinator of the Jacques Delors think tanks networks, prepared a paper on European defense (forthcoming) for the Evian Meeting.

1. Introduction

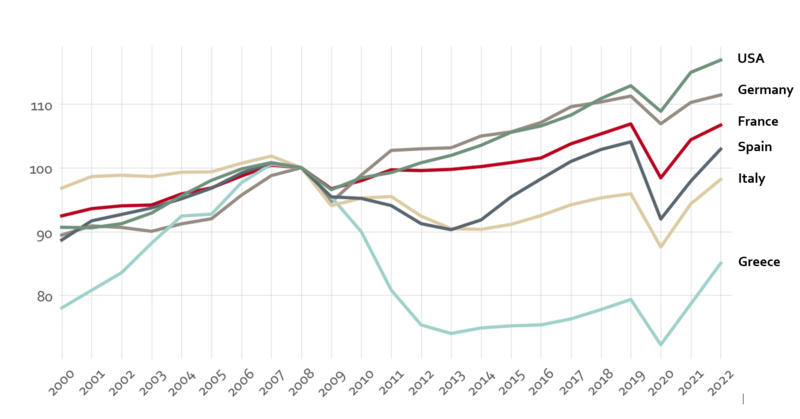

The EU’s competitiveness is under severe threat. While Europe remains one of the most innovative, secure, and prosperous regions, it is falling behind the US and losing ground vis-à-vis China on various key metrics. One figure epitomizing this development is GDP per capita growth, in which the US has been outperforming Europe over the last decade (see figure 1). More granular warning signs underpinning this development include, for example, the number of information and communications technology (ICT) patents and levels of foreign direct investment (FDI). ICT patents, as an indicator for competitiveness in key up and coming markets, have surged in China, while Europe is struggling to keep up. As an indicator for a region’s economic attractiveness, FDI is at a high level in the EU, but has decreased by 68% in 2021 relative to 2019 (i.e. pre-Covid), whereas in the US it is up by 63%.

Figure 1: GDP levels per capita, indexed to 100 in 2008, constant PPP

While many factors holding back EU competitiveness are long-standing, recent developments have roiled the continent’s outlook further and underscore the need for EU action. This policy brief covers three of those challenges and provides concrete recommendations for how to tackle them: i) devising an EU industrial policy and responding to foreign subsidies, such as contained within the US Inflation Reduction Act; ii) adapting to the changing energy landscape and reducing high prices; and iii) positioning the EU economy in a geopolitically fraught environment. Addressing longstanding issues, such as the availability of skilled labour, digitalization, demography, and the quality of infrastructure, is crucial for EU competitiveness. However, the brief focuses on the three factors mentioned above because of their recent emergence, their significance for the EU, and the fact that the direction of Europe’s chosen response is still unclear.

2. Devising a smart European industrial strategy

The EU must draw up its own industrial policy, one above all designed for the green economy. Two new drivers are putting some business models at risk: higher energy prices (covered in the section below) and the ramping up of industrial policy abroad, most visible in high subsidies. While Chinese industrial policy is not new, the US has been ramping up its own version recently, which comes on top of new US spending programmes for infrastructure (such as the Bipartisan Infrastructure Deal). This extensive US support poses challenges particularly for EU companies active in advanced digital technologies, given the US Chips and Science Act, or in clean technologies, for which the US Inflation Reduction Act (IRA) is a game changer.

While the IRA should be welcomed for driving down US CO2 emissions, it poses an economic challenge for EU clean tech industries. This risk stems mainly from two of its characteristics: First, its financial volume is huge (some estimates reaching USD 1.2 trillion), and very generous for some specific sectors. In multiple sectors, the amounts are thus significantly higher than what is on the table in Europe, despite the sizeable funds available via Next Generation EU and member state coffers. Second, by working through the tax code, support is highly predictable over the Act’s 10-year time horizon and operationally very easy to access, unlike in the EU.

The IRA substantially lowers production costs for a variety of products. For instance, the cost of US-manufactured solar modules is expected to decrease by up to 60%, making them the cheapest worldwide. For EV batteries, the US and Europe had roughly the same production costs, whereas with the IRA, American prices are expected to drop by nearly a third, posing a risk for the EU’s automotive industry’s prospects. The IRA also provides a lavish subsidy for hydrogen (of up to $3/kg), which drives down prices to levels much lower than in the EU, unless more support is forthcoming. Cheap hydrogen makes the US a premier location for investments related to the whole hydrogen economy, which is expected to be a major market. For other cleantech sectors, including the wind component industry, the picture is similar. For companies’ bottom line, this has big, clear-cut effects. For instance, the solar panel factory 3Sun receives EU funds amounting to €188 million. If 3Sun were located in the US, in the IRA’s lifetime it could receive a whopping USD 1.26 billion in production subsidies.

The current EU approach risks distortions in the single market, absent more common EU financing. In response to the IRA, the EU Commission made state aid rules more flexible, allowing member states to match the amount of foreign subsidies. However, only deep-pocketed member states are in a position to do so, creating a risk of distortion, with richer ones pulling away economically - and not just in clean tech.

While the IRA has galvanized calls for EU action in the clean tech sectors, coherent industrial policies are needed also in many other industries, in particular energy and the digital economy. Industrial policy in the US and China is, crucially, not restricted to counterbalancing negative externalities, as is arguably the case in the clean tech sector. Instead, the US and China use various methods (including protectionist instruments) to give strategically important sectors an edge. This is particularly pronounced in the semiconductor industry and in the value-chains surrounding artificial intelligence. EU institutions and national governments might have preferred sticking with a less interventionist economic policy paradigm and strict state aid rules, but with industrial policy set to be “the new normal” internationally, Europe must respond in kind.

Recommendations

First, in setting up its industrial policy, the EU needs to be selective and consider its strengths and weaknesses. For some technologies the EU wants to onshore with its proposed Net Zero Industry Act, there is neither a good economic nor security-of-supply reason. For instance, Europe has almost no solar industry today, and competing with foreign subsidies would be expensive for EU taxpayers. Given that profit margins are likely to stay low, substituting imports of solar products with domestic production does not seem economically prudent for Europe, given high fiscal cost of required subsidies. Second, the resilience (security of supply) risk for solar is likely lower than often portrayed, given that global manufacturing overcapacity is expected, with nations like India ramping up production capacity. At the same time, ensuring competitiveness in key sectors that have spill-over effects for the economies at large can also justify a more active policy stance. When devising industrial policy, in cleantech and elsewhere, European policymakers should thus answer a simple question more often: Where is support really needed -- and is it worth it in the long run?

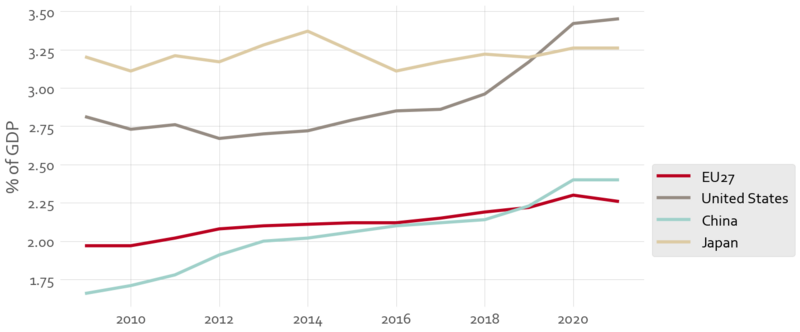

Second, to stay ahead of the curve, the EU needs to increase R&D spending. In the US, spending on R&D relative to GDP has outpaced European spending for ages. In 2010, the US spent 2.7%, the EU only 2%; in 2021, the US was at 3.5%, and the EU at 2.3%. China overtook the EU in 2019 (see Figure 2). EU industrial policy should create the conditions to increase both public and private sector R&D spending, to ensure that Europe continues to be among the innovation leaders and produce products and services with high value-add. That means continuing to invest in Europe’s high-performing higher educational system.

Figure 2: GDP domestic expenditure on R&D

Third, the financing strategy for EU industrial policy needs to avoid distortions in the single market and harness private financing. Some degree of concentration of investment in industries in member states like Germany or France should be expected, given positive agglomeration effects and the extant industrial base. Moreover, other EU countries often also benefit indirectly from investments made in Germany or France as these have spill-over effects and ensure that industry is kept in Europe. However, if increasingly loose state aid rules are not balanced with strong common EU support for fiscally weaker member states, the integrity of the Single Market will be at risk. By providing additional EU funds, each country – including those that are fiscally constrained – could undertake a minimum level of industrial policy support, levelling the playing field. However, this seems unlikely to materialize in the near term, given that the “sovereignty fund” – which was put forward to accomplish this – has been displaced with the rather low-ambition platform ‘STEP’. Moreover, while getting public spending right is crucial and EU financing should remain an objective for the medium-term (i.e., the next Multiannual Financial Framework in 2028-2034), the lion’s share of investment will have to come from the private sector. Here, finally completing the Capital and Markets Union remains vital.

Lastly, EU industrial policy needs smarter operational governance. Critically, EU support needs, first of all, to become less bureaucratic. This entails reducing both red-tape and over-specifying permissible actions, instead more often relying on defining binding objectives while giving the private sector more leeway in how to achieve them. It also means adapting the process of Important Projects of Common European Interest to allow much faster disbursement. Second, the quality of EU regulation seems to have deteriorated in recent years (with the high pace of rolling out Green Deal legislation) and must improve by addressing inconsistencies and implementation challenges. This is a tall order, since getting industrial policy right is notoriously hard. Hence, the EU Commission needs to be properly equipped to fulfil its new and notably demanding steering function. This requires far more expert staff and dedicated institutional structures, as well as substantially improving data availability to inform decisions (such as data on investments in EU countries or manufacturing capacity). Third, the EU should utilize its broad toolbox, which unlike in the US consists of not just the carrot (subsidies) but also the stick. The latter includes a range of instruments: emissions pricing (ETS 1 and 2), the Carbon Border Adjustment Mechanism, bans (like the de-facto phase-out of the combustion engine for cars), or setting minimum requirements (e.g. stipulating that a certain percentage of hydrogen used in industry must be renewable). A smart combination of stick and carrot will allow the EU to design more effective and cheaper support mechanisms, while maintaining operational leanness.

3. Adjusting to the new energy realities

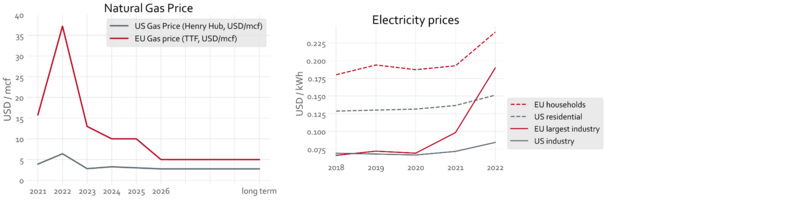

Energy in Europe will continue to be more expensive than elsewhere. With the disruption of gas supplies and the Russian war in Ukraine, energy prices in the EU skyrocketed in 2022. While prices have rapidly come down since then, fossil-based energy will remain costlier in Europe than elsewhere. Figure 3 shows that the EU natural gas price is expected to decrease in the next few years but still stay almost twice as high as in the US in the longer term. Detrimental for EU competitiveness, a cost gap will remain during and after the clean energy transition: Since Europe has lower renewables potential than other world regions that are sunnier, windier and have more space, renewable energy will be more expensive here. Given political opposition as well as forecasted costs, the likelihood of nuclear energy transforming the situation for the EU as a whole is slim. Hence, soaring energy prices clearly pose a competitiveness risk for EU producers of highly-energy intensive industries.

Figure 3: Natural gas price and electricity prices in the US and EU

Within Europe, the geographic distribution of relative energy prices will shift with the energy transition. While industry-heavy countries like Germany enjoyed low fossil fuel prices, renewable energy costs will be lower in e.g. Spain or Southern Italy. Should nuclear electricity become cheaper and compete on price with renewables in the longer term (which is not forecasted), opposition to nuclear in e.g. Germany would prevent many of today’s industrial hubs from gaining the full benefit. Consequently, the optimal location of highly-energy intensive industries within the EU is changing. Existing network and cluster effects, as well as friction costs, will reduce this pull towards cheap, clean energy somewhat but not entirely.

Member state divisions on energy strategies hamper effective and rapid policy action. On paper, EU leaders agree that member states may decide their own energy mix. However, different outlooks on the future role for nuclear and energy-intensive industries impede progress e.g. for hydrogen production, or for aligning on where to expand cross-border grids. These political delays hamper EU competitiveness, since final investment decisions often remain in limbo until regulatory clarity is achieved.

Recommendations

Across Europe, decisive policy action is needed to decrease energy costs. First and foremost, the supply of clean energy must be increased. Policy makers should take a pragmatic approach regarding nuclear and renewables, recognizing and accepting that different countries pursue different energy mixes. However, regardless of nuclear’s future role, deployment of solar and wind parks must be accelerated in all countries. Second, energy demand must be decreased, by increasing efficiency along with behavioural changes. Third, the flexibility of the energy system must be enhanced, which includes increasing storage capacity and mixing demand side policies. Finally, cross-border energy infrastructure, both electricity grids and hydrogen pipelines, must be planned adequately at EU level and quickly built to meet increasing future demand.

Relocation of industries within the EU to areas with cheap energy can increase overall efficiency and should not be prevented with permanent subsidies at unreasonable cost for taxpayers. Even with cost reductions along the lines set out above, sizeable energy cost differences between locations will remain for the foreseeable future. In many instances, permanently spending large subsidies to keep energy-intensive industries in their original location is not worth the candle. While relocation within the EU may inflict short-term pain on a country or region, it can increase efficiency from an EU perspective. Consequently, the EU Commission should scrutinize with a fine tooth-comb national schemes to lower the energy price for local industry, ensuring they do not induce distortions. Moreover, production of some low-value-add, low-labour-intensive goods can quit the EU at little detriment.

National energy policy needs stronger alignment and coordination. Given the clear European dimension of many energy dossiers, continuing the confrontations between member states and prioritising national solo efforts will come at high cost, as seen for instance with hydrogen, nuclear, electricity market reform, or cushioning energy prices for households. National leaders should try much harder to align and find common ground on energy policy, allowing rapid progress on critical projects – not just to reach climate targets, but create greater clarity for industry.

4. Adapting to the changing geopolitical environment

Geopolitical tensions are posing significant challenges to Europe‘s long-term economic competitiveness. Russia‘s war against Ukraine, on top of causing energy price inflation, has led to disruptions and price surges in strategic commodities like aluminium, palladium, and nickel. The EU‘s dependence on these resources has constrained its ability to impose sanctions on Russian raw material companies, once again highlighting the vulnerabilities that arise from excessively concentrated supply chains. At the same time, the EU is caught up in an industrial policy race. China has long employed subsidies and protectionist measures, while the recent U.S. industrial strategy now also involves substantial public financial support for strategic industries. These shifts in the geopolitical environment put Europe‘s economic model and industrial policy on an unsustainable trajectory. The EU has built its economic success on open international trade and market relations, with China as a significant partner. Greater geopolitical tensions now call for a rethink of the EU‘s economic model.

Europe‘s long-term economic competitiveness depends on deep and resilient value chains. The Green Deal Agenda, Europe’s economic and social development strategy, aims to make the EU carbon neutral by 2050 and transform it into the world’s most competitive hub for zero-carbon and digital technology innovation and manufacturing. However, this transformation is highly mineral-intensive and will hugely drive up EU demand for certain materials, most of which now come from China. According to European Commission data, Europe‘s demand for rare earths and lithium, crucial for wind energy and electric vehicles, is projected to increase between five and 12 times for rare earths and nearly 60 times for lithium by 2050. Yet, in 2020, the EU sourced all its rare earths from China and relied on Chile for 78% of its lithium needs. There was no domestic source of materials for the wind sector and only 1% for batteries.

Asymmetric economic interdependence makes the EU vulnerable to external shocks and the potential weaponization of trade relations. These vulnerabilities are exacerbated by the global zero-carbon technology race, which will further intensify competition for strategic minerals and industrial policy. To mitigate these risks, the EU has introduced a series of regulations and tools aimed at strengthening value chains domestically and externally, as well as enhancing its ability to respond to aggressive trade and industrial policy actions from third countries. These measures include the twin proposal for a Critical Raw Materials and a Net-Zero Industry Act, designed to fortify value chains within Europe. And they span renewed efforts to forge economic relations with countries in Latin America, Asia, and Africa. Additionally, in her 2023 State of the Union Speech, Commission President von der Leyen announced an investigation into Electric Vehicles imported from China due to concerns over unfair state subsidies. At the same time, the US has long pushed the EU and its member states to align with its more assertive stance on China, especially in terms of containing China‘s technological and industrial advance in strategic sectors.

The reconfiguration of the EU‘s foreign economic policy approach also carries risks, as it could trigger similar actions from third countries, most notably China, and jeopardize the EU‘s access to strategic markets and essential materials. Major European firms, including German automobile companies, heavily rely on Chinese markets for exports, with EU exports to China increasing by 75% in value since 2012 to reach €230 billion. Moreover, European firms depend on China for many raw materials and intermediary goods. In 2021, 20% of the EU‘s imports, valued at over €600 billion, came from China, tripling since 2012. Beyond the risk of countermeasures by third countries compromising market access and resource supplies, a reconfigured foreign economic policy might also complicate the EU‘s ability to develop economic relations that reduce dependencies and enhance resilience. If this involves restricting trade initiatives to countries that fully align with the EU‘s economic security concerns and values, it could limit the EU‘s partnership options and its efforts to diversify value chains. South Africa and Brazil, for instance, as raw materials powerhouses, respectively supply the EU with over 70% of its platinum and over 90% of its niobium needs. Both countries, however, maintain strong economic relations with China.

Recommendations

The EU should enhance its domestic value chains and reduce import dependencies by overhauling its green industrial policy approach. If the EU is serious about resilience and the twin transition, it needs to recognize the associated costs and mobilize substantial funding to support selected areas of green and digital industries at the European level. Equally important, the EU should foster domestic production and recycling capacities for the critical raw materials on which economic transformation depends. However, the EU should hedge against the risks of fueling a global subsidies race or a protectionist spiral. It should ensure the compatibility of its green industrial policy measures with the norms of global trade, avoiding local content requirements or subsidies with no coherent rationale.

Second, together with member states, the EU should align new international partnerships and trade relations with financial assistance to promote the diversification of critical value chains. The EU should utilize the full range of trade policy tools and complement trade agreements and multilateral approaches with bespoke, issue-specific ones. This will enable the EU to better tailor trade relations to the interests and capacities of individual countries. And it should coordinate these efforts closely with member states and their existing international relations. As part of this, the EU should invest diplomatic and financial resources in building new resource alliances, such as the recently proposed Critical Raw Materials Club. Such partnerships can strengthen critical value chains and mitigate the risks associated with economic interdependencies, including the increased imposition of export restrictions on critical raw materials in recent years. However, the EU’s trade and international partnership policies must not negatively impact vulnerable countries or regions, or prescribe economic and trade policy stances. Rather, the EU should co-design these with its partners. This includes tailoring financial, capacity-building, and technological assistance to local needs, capabilities, and interests. This is crucial for maintaining the EU‘s credibility and legitimacy in the Global South and establishing EU-South cooperation.

Lastly, it is crucial for the EU to work towards strengthening the institutional architecture and fortifying the legitimacy of the global trade regime. The EU should pursue World Trade Organization (WTO) reform and adapt it to the new realities of a complex and multipolar world. It should make efforts to achieve a new consensus on trade rules and enforcement. This includes adapting the Dispute Settlement System. Prioritizing reciprocal market access is important, alongside integrating collectively negotiated and agreed climate and human rights standards into the rules and norms of international trade. The EU must also work towards updating the Agreement on Subsidies and Countervailing Measures to effectively manage the global subsidy race. Recognizing that this race is here to stay, it is essential to establish a framework that enhances transparency on how subsidies are deployed - a crucial step towards regulating them.