With the Transmission Protection Instrument (TPI), the ECB has significantly widened its toolbox. However, the implications of the new program go beyond monetary policy. By linking bond purchases to member states following the EU’s economic governance framework, the central bank has potentially increased the size of the gun the Commission and the Council can wield to incentivize compliance. But it has also made it much harder to pull the trigger. Without reforms, the new ECB program will therefore accentuate existing deficiencies of the rulebook. The onus is now on politics to change that.

On July 21st, the European Central Bank (ECB) announced the latest addition to its monetary policy arsenal. If member states experience unjustified increases in borrowing costs, the ECB can now buy their bonds under the new Transmission Protection Instrument (TPI). This reduces the risk that panicky market sell-offs put a wedge into domestic financing costs in different member states and for ECB rate hikes to lead to inflationary outcomes in Germany and deflationary ones in Italy. In a context in which the ECB is confronted with spiraling prices and a looming recession, this is good news.

However, the implications of July's decision go beyond the realm of monetary policy. The ECB’s eligibility criteria for the new instrument rely heavily on the EU’s economic governance framework. This increases the size of the gun the Commission and the Council can wield to incentivize compliance with its rulebook. But it also makes it much harder to pull the trigger. If the Commission and the Council declare member states to have broken the rules, they could now effectively bar them from a critical instrument. This raises the stakes for doing so significantly.

Without reforms, the new ECB program is therefore likely to heighten existing deficiencies in EU economic governance. Especially the fiscal framework is too rigid on paper and too flexible in practice to serve as a constructive guideline for policy making. As it stands, the new weight attached to it will most likely increase the tendency not to enforce, which would further undermine the credibility of the framework and leave the ECB without meaningful political parameters on when to intervene.

The TPI thus puts the onus on politics. To provide the ECB with a meaningful corridor for when the application of the instrument is acceptable, the EU needs a clear, economically justified and politically-backed idea about what policies it sees as being conducive to its economic goals. And it also has to define under what circumstances it would be ready to signal to the ECB that this is no longer the case.

How the new instrument will work

The declared goal of the TPI is to ensure even monetary transmission. In plain language, this means that the bank wants to root-out the possibility that its forthcoming rate hikes prompt sudden and unwarranted spread for some member states. From the ECB’s perspective, these are problematic as they put big wedges in the borrowing costs between member states and make it difficult to navigate the complex inflationary environment it currently faces.

Under the new program, the ECB will, thus, buy government bonds with maturities between one and ten years of any member state “experiencing a deterioration in financing conditions not warranted by country-specific fundamentals”. There is no ex-ante limit to the purchases of individual bonds and their size will “depend on the severity of the risks”. However, the usage of the TPI is based on several conditions.

For one, the ECB can only activate the TPI if doing so is strictly necessary to support the effective transmission of monetary policy, meaning if rising spreads actually translate into diverging private borrowing costs across member states. Second, it can only address unwarranted and disorderly spreads. If interest rate differentials, for example, widen as a result of a changing economic outlook or political insecurity, the ECB is not allowed not interfere. Of course, the tricky bit is how to differentiate between justified and unjustified spreads. While hard to measure, the existence of unwarranted spreads has been established in economic research and EU case law, and the European Court of Justice has granted the ECB Governing Council wide discretion in determining to what degree a neutralization of spreads is necessary to ensure the functioning transmission of monetary policy. Furthermore, bond purchases can only take place on secondary markets and member states must still have access to the bond market.

Moreover, the ECB must ensure that the program only supports and does not counteract the general economic policy goals of the Union. To judge eligibility, the ECB therefore relies on four criteria:

- Compliance with the EU fiscal framework: Member states cannot be subject to an excessive deficit procedure (EDP) and be assessed as having failed to take effective action in response to an EU Council recommendation.

- Absence of severe macroeconomic imbalances: Member states cannot be subject to an excessive imbalance procedure (EIP) and be assessed as having failed to take corrective action in response to an EU Council recommendation.

- Fiscal sustainability: Public debt must be deemed sustainable based on the ECB’s own analysis considering also debt sustainability analyses by the European Commission, the ESM, the IMF and other institutions.

- Sound and sustainable macroeconomic policies: Member states must comply with the commitments set out in the NRRPs and the country-specific recommendations (CSRs) in the fiscal sphere under the European Semester.

Two things are important here: First, the ECB does not establish the economic and fiscal policy conditions as binding criteria. The communication states that the four conditions above serve as input into the ECB’s Governing Council’s decision-making and can be adjusted in light of “unfolding risks”. This sounds noncommittal but could alleviate some legal concerns. In the past, the ECB has been criticized – amongst others by the German Court of Justice – for edging too close to conducting economic policy by tying its interventions under the Outright Monetary Transactions Program strictly, to a program with the European Stability Mechanism (ESM). Avoiding this for the TPI could, thus, serve to strengthen the bank’s independence and focus on monetary policy. From a political perspective, however, the publication of the criteria still means that it is highly unlikely that member states can be in open breach with them and still remain eligible for purchases under the TPI.

Second, the eligibility criteria encompass practically all aspects of EU economic governance. This makes sense. These are the rules that the EU demands member states follow in order to conduct economic policies in line with the Union’s interest, and it would be difficult for the ECB to prioritize certain aspects of the politically-defined rulebook over others. However, it also means that the political eligibility criteria for the new instrument reflect the ambiguities of the current rules.

What the TPI means for EU economic governance

Three of the ECB’s four criteria are directly tied to economic governance. Two of them (compliance with the EU fiscal framework and absence of severe macroeconomic imbalances) refer to specific procedures that can result in a clear establishment of non-compliance. The other one (sound and sustainable macroeconomic policies) demands a broader judgement about whether member states act in line with parts of the Commission’s country-specific recommendations. To understand the implications of the new instrument, the fine print of both kind of process matters.

The TPI accentuates the existing dilemmas of the EU’s fiscal rules

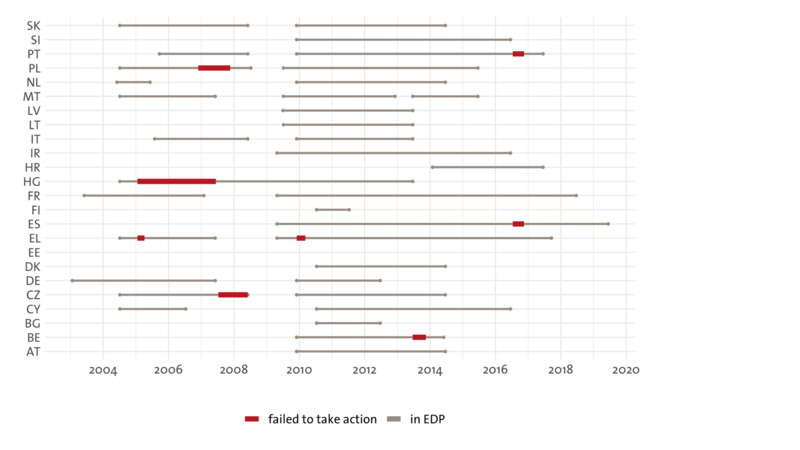

Of the first two criteria, only the EDP is likely to matter for TPI eligibility. The Macroeconomic Imbalance Procedure was established more than a decade ago but has so far gained little traction in the EU’s economic governance framework and an excessive imbalance – as mentioned in the ECB communication – has never been formally established. In all likelihood, the new instrument will not change this.

Things look different for the EDP. The TPI adds teeth to the corrective arm of the fiscal rules but will in practice also make enforcement less likely. To fall short of the requirement to comply with the fiscal framework, two things are necessary. First, member states must have an excessive deficit. The Council can decide to put member states into an EDP if their deficit exceeds 3% of GDP and is not exceptional and temporary, or if they record debt levels above 60% of GDP and fail to reduce the gap to this target mark by 1/20 every year.

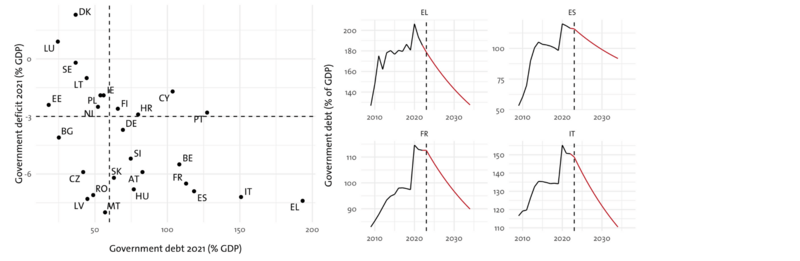

On its own, this requirement would set an unrealistically high bar for TPI eligibility. Since the introduction of the Euro, all member states except Estonia, Luxemburg, and Sweden have been subject to an EDP at least once. While the fiscal rules are on hold until the end of 2023, reapplying them would currently put a large number of Eurozone member states into an EDP. Highly indebted countries such as Italy, Spain, France or Portugal would then need to reduce their debt levels by between three and five percentage points every year in order to meet the 1/20 reduction target (Figure 2). There is a broad consensus amongst economists that this would require primary surpluses that are neither politically feasible nor economically wise.

However, to be barred from TPI access, countries would not only need to be in an EDP. Member states would also need to be found not to have taken effective action to address the excess. This happens much more rarely. The process of declaring non-effective action comes with a lot of political discretion. After the start of an EDP, member states have between 3 and 6 months to implement measures recommended by the Council. After that, the Commission evaluates the policy response, the Council signs off the assessment and can then decide to formally establish inadequate action, which also provides the first step toward financial sanctions. It seldomly does so. Only six countries were ever found not to have taken effective action and usually the status does not last long (see Figure 2).

While on paper, the EDP criteria of the TPI could provide highly indebted member states with a strong incentive to follow the EU’s fiscal framework, in practice it is, thus, currently unlikely to do so. On the one hand, the numeric goals set forth in the corrective arm of the Stability and Growth Pact (SGP) will remain practically unreachable for most countries for which the TPI could matter, and everyone involved knows that. On the other hand, the Council has been hesitant to take steps toward sanctions in the past and will most likely be even more so now that declaring inadequate action could mean closing TPI access. The new instrument will thus simply accentuate the existing dilemmas of the EDP.

The TPI adds to weight to the Semester but raises questions on what counts as compliance

Finally, the ECB lists “sound and sustainable macroeconomic policies” as a criterion for program eligibility. According to the communication, this means adhering to the commitments set out in the NRRPs and following the Commission’s fiscal CSRs. This adds to the existing trend of equipping the European Semester with some real incentives, but also raises questions concerning the definition of compliance in this area.

First, the TPI raises the stakes for member states to follow their agreed reform and investment plans to access the loans and grants available under the Recovery Instrument. These plans include milestones and targets for specific investments but also a substantial share of the reform recommendations issued by the Commission under the European Semester. Failing to fulfill these plans could now not only come with hefty financial losses. It could also put member states outside of the scope of ECB bond purchases.

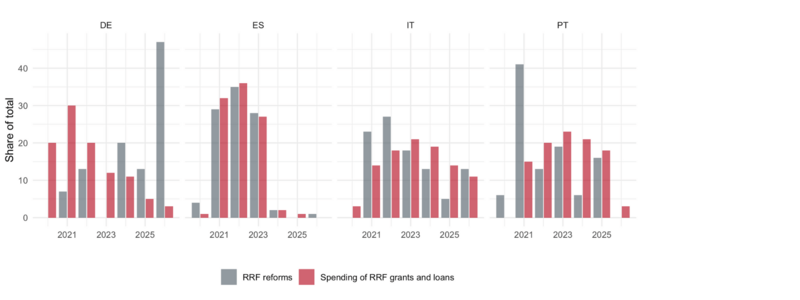

This is especially important as the NRRPs of some highly indebted member states rank amongst the most ambitious ones. Italy, for example, will need to fulfill 55 reform and investment milestones by the end of 2022. Amongst them are reforms in highly controversial areas such as competition and judicial policy that played a key role in the collapse of the Draghi government. And while the Italian plan frontloaded a lot of the most important reforms to the beginning of the early RRF years, in other countries the bulk of the reform efforts are yet to come (see Figure 3). Implementation will, thus, get harder over time and the TPI could potentially make deviating from the plans a lot costlier.

The TPI will also complicate future renegotiations of parts of the plans. The RRF process is less static than often assumed. If the Commission and the Council agree, member states can adapt their plans in light of changing circumstances. Some revisions are already on the agenda, as plans will need to be adapted to the changing distribution of grants based on updated growth rates for 2020 and 2021. Also, the Commission now wants member states to add new investments and reforms to reach energy independence goals. All these changes will now take place in a context in which they can have a direct bearing on eligibility for the new ECB program.

Second, the TPI could also be relevant for CSRs outside the current plans. According to the communication, eligible countries will need to comply with recommendations made in the “fiscal sphere” under the Semester. Fiscal CSRs have been largely excluded from the recovery plans and mostly focus on measures that member states should take to reach goals of the preventive arm of the SGP to avoid building up excessive deficits in the first place. Fiscal CSRs usually refer to the medium-term budgetary objective (MTO), which constitutes a structural deficit between 0.5% and 1% of GDP depending on the member state’s debt level and fiscal sustainability, and sometimes entail budgetary measures outside the SGP.

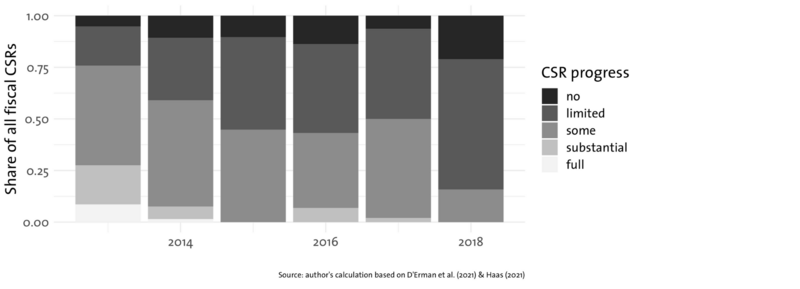

Compliance with the fiscal recommendations of the Commission has always been low and further declined in the years prior to the pandemic. The reasons for that are manifold. The rules are complex, have often been criticized for being pro-cyclical, ownership amongst member states is low and – as with the rest of the Semester – the Commission until now had neither a real stick nor a carrot to encourage member states to heed its advice. The fact that compliance is now relevant for TPI access could change that.

The TPI decision could thus intensify a trend toward stronger economic coordination that already started with the recovery instrument. Before the pandemic, the European Semester was largely perceived as a multi-institutional paper pusher. Making RRF money conditional on substantial CSR compliance, for the first time, added some real teeth. Now ECB program access could come on top and broaden the scope to fiscal recommendation. However, important questions remain on what counts as compliance.

Neither the RRF nor the Semester have formal procedures that could establish broad non-compliance. For the RRF, failure to reach certain milestones can lead to a suspension of payments. It will not result in cutting entire tranches, but in a reduction of payouts that corresponds to the relevance of the missed targets. Similarly, compliance under the Semester is monitored by the Commission, and an evaluation of reform progress for each recommendation is published every year, ranging from no to full progress. Compliance in both cases is not a yes or no decision.

TPI eligibility will thus reflect member states’ broader willingness to cooperate within the EU processes. This is a very broad criterion and a very political one. What meets the bar of sound and sustainable macro-economic policies will need to be negotiated between the Commission and the member states and it is unlikely that the ECB would declare a breach of this criterion without a clear political signal from the Council and the Commission. However, the possibility alone that the Commission and the Council could now call TPI access into question if member states do not follow their recommendations will further politicize the process.

Way forward: No way around meaningful reforms anymore

Since the publication of the TPI communication, the ECB has been criticized for relying on vague criteria that grant too much discretion on when to buy bonds. The diagnosis part of this argument has some truth to it. In their current form, the criteria have some obvious weaknesses when it comes to defining a clear political corridor for what counts as sound and sustainable macroeconomic policies and what not.

However, the criticism is very much misdirected. The TPI criteria rely on practically all economic governance rules the EU and its member states have designed to coordinate their policies around common goals. This is the right thing to do. However, it also means that they reflect all the advantages and deficiencies of the current rulebook. For that, the onus is on politics. And the best thing to do about it is to fix the rules.

First, the Commission and the member states should double down on the ongoing efforts to reform the fiscal framework. The flaws of the current rules have long been established. The TPI makes the status quo even less desirable for everyone. Highly-indebted member states will now live under the constant threat of losing TPI access. While they could bank on the hope that the Commission and the Council will keep shying away from enforcing the rules, the new ECB program has increased the stakes of this bet a lot. Countries that have an interest in strong and enforceable rules, on the other hand, should realize that the TPI makes the current framework even more inapplicable. This will induce a lot of uncertainty into the financial markets and undermine the credibility of fiscal coordination in the long-run.

The technical ideas for how to get to a more reliable and constructive framework are already on the table (e.g. here, here, here). The TPI adds the requirement that new rules need to provide a clear benchmark for when ECB bond purchases under the new program are politically no longer warranted. A lot of thought will need to go into what balance member states want to strike here between financial stability on the one hand and fiscal sustainability on the other. This is a tricky issue, but clearly one that will have to be solved by politics.

Second, the European Semester cannot be turned back to a technocratic paper pusher anymore. The incorporation of the RRF into the Semester has already transformed it from a largely toothless inter-institutional ritual into a meaningful political process. The TPI now, for the first time, introduces an incentive that has no clear expiration date. While the RRF will cease to exist by 2026, the TPI will not.

This has two implications. First, the CSRs will remain politically relevant. If compliance with the recommendations is one of the yardsticks for TPI access, the definition of the most important CSRs will remain a highly political process – at least for those member states for which TPI access is a real concern. Given that the ECB needs a clear signal for whether overall progress meets the political bar for sound macroeconomic policies or not, this also requires some form of prioritization. Second, the TPI could hint at the contours of a future reform and investment instrument. One question was always what carrots the EU can put on the table in exchange for reform implementation in the likely case that it has less money to offer after NextGenEU. At least for highly indebted member states, TPI access will be part of the answer.