Russia’s invasion of Ukraine puts EU economic policy making on the spot. At the beginning of the war, there was some uncertainty whether the combination of dampening growth, rising energy prices and new investment needs would warrant new common EU spending. However, in recent weeks the fog has cleared. It is now evident, that without additional common expenditures the EU risks undermining its common position towards Russia and that new money is needed to finance necessary investments in energy independence.

1. Introduction

Russia’s invasion of Ukraine puts EU economic policy making on the spot. Acute uncertainty and spiraling prices are dampening growth. Inflation has hit new highs. Energy bills at record levels. And the need to wean Europe off Russian energy and achieve climate targets as well as to boost defense spending will require massive additional EU-wide investments when shared resources are already scarce.

At the beginning of the war, there was some pushback against the idea that these issues would require more common EU spending. Given the large uncertainties surrounding the economic impact of the war, the price tag of additional investment needs and remaining resources at the EU level, this skepticism was legitimate. However, in recent weeks the fog has cleared substantially.

For one, it is now evident that the war will have very different economic impacts across member states. This matters not just economically but also politically and the disputes over the sixth round of sanctions proved how difficult it will be to maintain a united front on Russia without some short-term burden sharing. Moreover, the Commission has now presented a detailed plan, REPowerEU, with a clear price tag on how to end Europe’s energy dependence. However, the financing side of the agenda consists of little more than rejigging existing funds and hoping that member states will take out EU loans that so far, they did not want. This simply will not do.

The question of more common expenditures therefore needs to get back on the agenda. Specifically, the EU will need joint spending in two areas:

- First, external unity demands internal solidarity. These huge differences in economic fallout and costs of dealing with higher energy prices will undermine the support for sanctions in the long-run and will make any broadening of the regime politically almost impossible. The EU therefore needs some short-term burden sharing. The best approach is a temporary and targeted instrument to support vulnerable households in specifically exposed member states.

- Second, common investments in energy independence are required to increase energy security, curb energy price inflation, and reach the EU’s climate goals. However, this would often require member states to spend large sums on projects that may have substantial European benefits but yield few direct national gains. Especially when national budgets are already under a lot of pressure, this is unlikely to happen without additional common resources.

Short-term challenge: cushioning rising energy prices in a downbeat economy

For the EU, the war’s most immediate economic impact is slowing growth and rising inflation. In its Spring forecast, the Commission has cut its EU-wide growth projections for 2022 from 4% to 2.7% with much of the remaining upswing stemming from statistical carry-overs of the strong rebound in the second half of 2021. Importantly, this is the most positive scenario. According to the Commission, a further escalation of the war or higher energy prices could bring the EU very close to a recession.

At the same time, the war is driving up prices. In May, year-on-year inflation in the Eurozone reached a historic high of 8.1%. While much of it is caused by higher energy and food costs, other prices are also picking up and core inflation (excluding energy and unprocessed goods) stood at 3.5% in May. Given that nominal wage growth is expected to be significantly below inflation, real wages are expected to decrease, and so is real disposable household income.

The EU’s response to this, so far, has been to grant member states more wiggle room to design national compensation policies. First, it has relaxed European state aid rules. In April, the Commission updated its guidelines to give national governments more leeway in temporarily supporting companies that suffer from exceptionally high energy prices. These rules are already active and will be in place at least until the end of 2022. Then, in early May the Commission proposed suspending the EU’s fiscal rules for another year. The so-called “general escape clause” was already active since the outbreak of the pandemic. Now the Commission wants to keep the main fiscal rules on hold until the end of 2023.

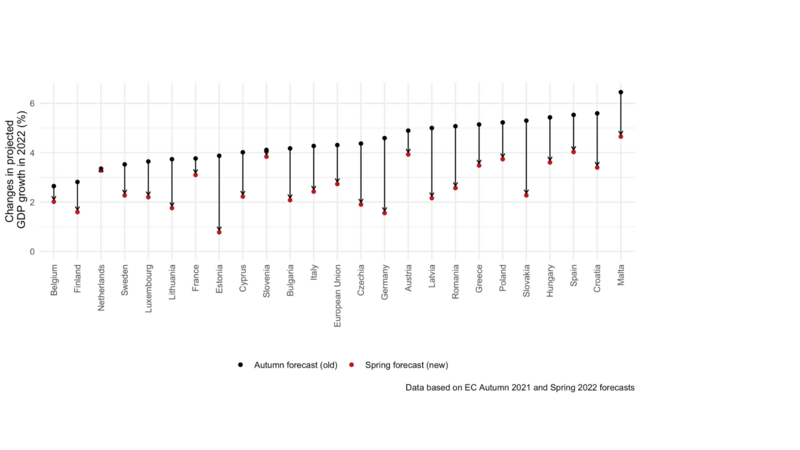

The short-term economic costs of the war differ dramatically across the EU

These steps are helpful in the short-run but they mean that the direct economic costs are borne exclusively by national budgets – and these costs differ enormously across countries. Early signs of this are already evident in the current projections. Figure 1 plots changes in projected growth rates for 2022 across EU member states. While the war has left growth projections for countries like the Netherlands, Belgium, or France almost untouched, it will likely cause a sizeable slowdown in Germany and Italy and some Eastern European member states. Again, these are the more optimistic projections. In more severe scenarios, recessions would be likely in several member states.

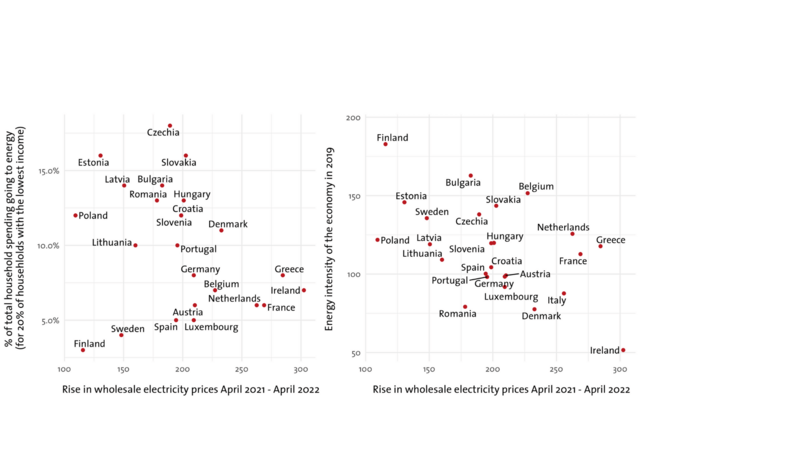

Critically, these differences are likely to grow the longer the war and the energy crisis it induced linger. Figure 2 illustrates this point. The left-hand side plots the increase in average wholesale electricity prices between April 2021 and April 2022 in each member state (as a proxy for overall energy price increases), against the share of overall spending of low-income households on energy related goods such as electricity, heating, and transport. The higher this proportion, the more vulnerable poor households are to higher energy bills, and the more governments will have to spend to shield them from hardship and energy poverty as a result of the common sanctions. To illustrate differences in vulnerability in the business sector, which governments would partially also need to support, the right-hand side plots rising electricity prices against the overall energy intensity of the economy.

Figure 2 shows two things. First, the vulnerability of member states to rising electricity prices differs dramatically for both households and the overall economy. And second, the costs are concentrated in some Central- and Eastern European countries such as Bulgaria, the Czech Republic and Romania which suffer from a doubling of electricity prices as well as high spending on energy in low-income households and by relatively energy intensive industries.

The metrics used here are far from perfect. They ignore the fact that energy consumption mixes differ across and within member states and that the prices for oil and natural gas do not match the development of electricity prices perfectly. However, recent analyses by Steckel et. al (2022) that are based on more fine-grained data and take these differences into account reveal similar patterns. European citizens in Central and Eastern Europe will suffer a lot more from the common sanctions and the rise in energy prices than citizens in many other member states.

External unity requires internal solidarity

So far, the picture does not amount to a full-blown economic crisis. However, the uneven distribution of the economic fallout matters politically. The lengthy negotiations and spotty implementation of the latest sanctions package revealed that countries hard-hit by sanctions will be increasingly reluctant to bear the brunt of the costs for the rest of the EU. Without some burden-sharing at the EU level, it will become increasingly hard to sustain the current sanctions against Russia and almost impossible to reach a consensus on more broad-based energy bans that hurt some member states much more than others.

To remain politically united and implement forceful policies against Russia, the EU therefore needs to balance some of the short-term economic burden of its common policies. Importantly, it needs to be ensured that such support does not result in broad-based fuel subsidies that are not just fiscally costly but also undermine the very goal of ending EU’s reliance on fossil fuels. The most targeted way to achieve this would be to focus EU level support on low-income households that are specifically exposed to the economic hardship wrought by the energy crisis.

An appropriate instrument would need to meet four criteria. First, it would need to be redistributive and support member states in proportion to their vulnerability towards spiraling energy prices. Support needs to be based on objective criteria such as energy mixes, dependencies, wholesale energy prices and indicators of social vulnerability.

Second, support needs to be targeted. The main goal would be to support member states in cushioning economic hardship. The chosen instrument should therefore be geared exclusively towards vulnerable households and ideally take the form of direct transfers that keep price signals intact. Third, the instrument should come with strong strings attached regarding accompanying national policies. For example, EU support should only be disbursed to member states whose domestic measures do not undermine common European goals, such as directly subsidizing energy bills. And finally, the instrument needs to be temporary by setting a clear expiration date in order not to stand in the way of necessary adjustments to permanently higher energy prices.

Critically, an instrument along these lines would be financially bearable. Steckel et. al (2022), for example, put the overall costs of targeted support for vulnerable households in all member states in the EU at about €90bn per year. Given the measure’s redistributive goal, relatively unaffected countries would not receive funding, and hence only a part of this sum would have to be borne at EU level. The required volume would also be relatively contained since effective tools, such as direct transfers, are a much cheaper way to support those in need, compared to e.g. subsidizing petrol for the entire population. To finance these expenditures, the EU could either rely on more common borrowing, or raise funds through possible tariffs on Russian energy imports. Most importantly, an instrument needs to be up and running before the coming winter when rising energy prices are going to bite especially hard.

1) Ending energy dependence on Russia by speeding up the green transition

Besides cushioning the direct economic impact of the war, the EU needs to tackle current economic issues at the roots: its dependency on Russian energy imports. Done right, substituting Russian fossil energy, chiefly by accelerating the shift to renewables, will increase energy security in the bloc, decrease imported energy inflation and help achieve the EU’s climate goals by reducing emissions. While a lot of hard economic choices have to be made in the current context, there is no choice but to double down on energy independence by speeding up the green energy transition.

In May, the Commission put forward a roadmap to achieve this goal. REPowerEU aims to reduce natural gas imports from Russia into the EU by two thirds by the end of this year and substitute all Russian energy imports by 2027. This rests on three pillars: first, the Commission wants to accelerate the rollout of renewable energies, raising the headline 2030 target from 40% to 45%. Second, the Commission wants to reduce energy consumption by increasing energy efficiency and campaigning for behavioral changes. And third, it aims to diversify energy imports through new energy partnerships, facilitated by common procurement.

While one can quibble about the details of the plan, REPowerEU does contain a wide array of sensible initiatives, including for instance a platform for common procurement of gas, LNG and hydrogen, a new solar initiative, an urgently needed simplification of permitting procedures for renewable energies, and a strategy on how to engage internationally to secure energy imports from elsewhere.

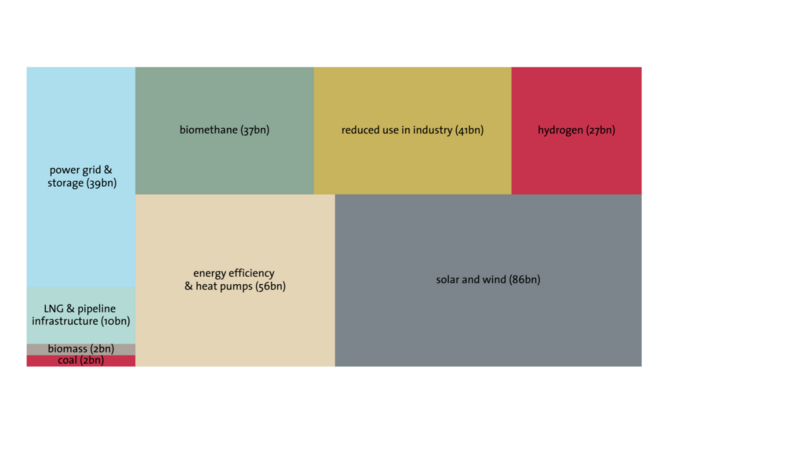

However, big question marks remain regarding the financing of the plan. Overall, the Commission estimates additional investment needs at about EUR 300 billion by 2030. EUR 210 billion would have to have been spent already by 2027, that is, in the EU’s current budget period. Figures 3 provides some more details on where funds would be earmarked in the Commission’s thinking. While the plan contains some additional investments in fossil fuel infrastructure, the bulk of the money would need to be spent on solar and wind energy, investment to increase energy efficiency and upgrading the European power grid to make sure that electricity gets to the places where it is needed. Crucially, these investments come on top of sums already required to achieve a 55% cut in EU emissions by 2030 under the FitFor55 package.

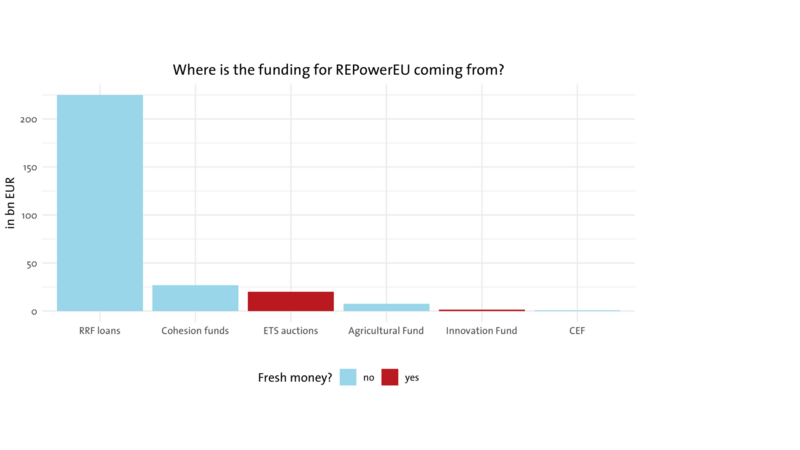

The new plan comes with a price-tag but almost no additional money attached to it. Financing the necessary investments would in large part rely upon rejigging existing funds. The Commission proposes to “mobilize” some €34bn by allowing member states to funnel money they would receive under the EU’s Cohesion- and Agriculture funds into the Recovery and Resilience Facility (RRF) to allow for more flexible usage. The EC also wants to raise EUR 20bn of fresh money from auctioning additional CO2 allowances through the Emissions Trading Scheme, which is a highly problematic approach, mainly for two reasons: it would tamper with the rules of the Market Stability Reserve, eroding trust in the whole CO2 market, and it would finance the green transition by allowing companies to emit more. For this and other reasons, selling additional CO2 allowances as proposed will face heavy resistance in Parliament and from member states. Either way, the bulk of the necessary investments (€225bn) would need to come out of national budgets, or by taking out untapped loans under the RRF – loans that so far most member states show no sign of wanting. For some member states, these loans do come with better financing conditions than national borrowing. However, they are fully repayable, are only disbursed if milestones are fulfilled, and count towards debt – consequently, so far, only seven member states have requested any loans from the Recovery Instrument.

Financing energy independence requires joint investments

In its current form, REPowerEU is unlikely to work. It largely rests on the hope that member states will take out interest-bearing, repayable loans to finance common energy independence. Critically, these investments in many cases would need to happen in places where the direct benefits are limited. To give one example, additional solar energy investments would (according to the Commission’s own estimates) be most useful in Spain. However, Spain does not rely on Russian energy imports and would not only have to finance investment in renewable energy plants but also into the necessary electricity grid infrastructure to allow this energy to flow to other, less sunny member states. Member states would also have to make these investments for common EU objectives when their budgets are already strained by the pandemic and they are confronted with rising spending needs for their armed forces and humanitarian aid as a result of the war. In short, individual member states might not be willing to invest enough of their own money, given a lack of incentives.

To have a realistic shot at achieving the goals set out in REPowerEU, the EU, therefore, needs additional common financing. Crucially, funds are needed before 2027, or still within the current budget period, since putting off this financing to the next budget period would come too late for investments to be initiated now. Given that any wiggle room in the MFF is generally limited and already largely depleted by the unforeseen spending needs for humanitarian action and costs of supporting Ukrainian refugees, having recourse to the existing budget is no option. The grant component of the RRF is already used up, hence using the existing RRF grants for REPowerEU projects would depend on member states’ willingness to forgo planned investments for the recovery, many of which are already destined for the green transition.

This leaves the EU with two options to finance the additional investment needs. Either member states will have to increase their contributions to the current MFF, or more money will need to be raised through additional common borrowing. The latter could be achieved through topping up the RRF with additional grants or transforming parts of the remaining loans in the RRF into grants. In any case, the political hurdles for all these options are high. However, if the EU serious about the goals set out in REPowerEU it will need to face them. Without common financing, funding will come up short and the EU runs a serious risk of failing to achieve green energy independence any time soon.

Conclusion

The deepest geopolitical crisis the EU has faced in the last 30 years requires common spending to address common challenges. Accepting this reality will understandably cause discomfort to many: the borrowing at EU level to tackle the pandemic fallout was designed to be a one-off. However, the bad timing of world crises cannot be an excuse for inaction. Without additional measures the EU could seriously undermine its geopolitical status and underfinance efforts to reach its most important economic and ecological goals in the years ahead. The risk of inaction is now much higher than that of action.